Economists estimate that organizations leveraging marginal benefit calculations can improve decision-making efficiency by up to 30%. Marginal benefit represents the additional gain obtained from consuming or producing one more unit of a good or service, making it a key concept for both businesses and individuals looking to make smarter choices.

Understanding and calculating marginal benefit helps identify the point at which the additional value of an action equals its cost, ensuring that resources, whether time, money, or effort, are used most effectively. It provides insight into decision-making, helping to optimize productivity and maximize returns in everyday activities and business operations.

In this article, we’ll walk you through how to calculate marginal benefit in 3 easy steps with practical examples.

What is Marginal Benefit?

The marginal benefit meaning refers to the additional satisfaction or value a consumer gains from consuming one more unit of a good or service. In simple terms, it’s the extra benefit you get from having a little more of something. This concept is fundamental in economics, as it helps explain consumer behavior and decision-making.

| Marginal Benefit = Extra Satisfaction from One More Unit |

As you consume more of a good or service, the marginal benefit typically decreases. This phenomenon is known as the law of diminishing marginal benefit. Understanding this principle helps individuals and businesses make informed choices about how much of a product or service to consume or produce.

Here is a formula to define marginal benefits:

| More Units Consued → Extra Satisfaction ↓ → Law of Diminishing Marginal Benefit |

Economists use marginal benefit to analyze how consumers allocate their resources. By comparing the marginal benefit to the marginal cost, the additional cost of producing one more unit, individuals and firms can determine the optimal level of consumption or production.

Why is Marginal Benefit Important?

Understanding marginal benefit, the additional satisfaction or value gained from consuming or producing one more unit of a good or service, is crucial for making informed decisions in both personal and business contexts. Here are some of the incremental benefits and why it’s so important:

1. Helps Make Smarter Decisions

Knowing how to calculate marginal benefit serves as an economic decision-making tool by evaluating the additional benefit derived from one more unit of consumption or production.

This approach allows individuals and businesses to assess whether the extra benefit justifies the additional cost. By focusing on marginal benefits, decision-makers can avoid overconsumption or overproduction, leading to more efficient choices.

2. Optimizes Resource Allocation

When it comes to calculating marginal benefit, resources such as time, money, and labor are limited, making efficient allocation essential. Marginal benefit helps in determining how to allocate these scarce resources effectively.

For example, if the marginal benefit of studying an extra hour outweighs the marginal cost (such as fatigue), it would be wise to allocate more time to studying.

In business, companies use marginal benefit to decide how to distribute resources among various projects or products, ensuring that each resource is used where it provides the most value.

3. Maximizes Satisfaction and Profit

By equating marginal benefit vs marginal cost, individuals and businesses can maximize their satisfaction or profit. This principle is rooted in the idea that resources should be used up to the point where the additional benefit equals the additional cost.

For consumers, this means making purchases that provide the most satisfaction per unit of currency spent. For businesses, it involves producing goods or services up to the point where the revenue from the last unit produced equals the cost of producing it.

4. Balances Costs and Benefits

Marginal benefit is integral to cost-benefit analysis, a fundamental concept in economics. It allows individuals and organizations to weigh the additional benefits of an action against its additional costs.

This balance helps in making decisions that lead to the most favorable outcomes. For instance, a government might use marginal benefit analysis to evaluate the effectiveness of a new policy by comparing the additional benefits it brings to the additional costs incurred.

5. Guides Personal and Business Strategy

In both personal and business contexts, knowing how to calculate marginal benefit informs strategy by highlighting the value of incremental changes. For individuals, understanding marginal benefit can guide choices related to spending, saving, and investing.

In business, it aids in strategic planning, such as determining the optimal level of production, setting prices, and managing inventory. By continuously assessing marginal benefits, both individuals and businesses can adapt to changing circumstances and make decisions.

What is the Marginal Benefit Formula?

In economics, the marginal benefit (MB) formula quantifies the additional satisfaction or value derived from consuming one more unit of a good or service. The marginal benefit equation is expressed as:

| MB = Δ Quantity / Δ Total Benefit |

Where:

Δ Total Benefit represents the change in total benefit (or satisfaction) from consuming additional units.

Δ Quantity denotes the change in the number of units consumed.

This formula illustrates how the marginal benefit decreases as more units are consumed, a principle known as the law of diminishing marginal benefit.

What Do “Change in Total Benefit” and “Change in Quantity” Mean?

Change in Total Benefit (Δ Total Benefit): This refers to the difference in total satisfaction or marginal utility before and after consuming additional units. It reflects how much more benefit is gained by increasing consumption.

Change in Quantity (Δ Quantity): This is the difference in the number of units consumed. It indicates how many additional units are being considered in the analysis.

These changes are crucial for understanding how consumption patterns affect overall satisfaction and for making decisions that maximize utility.

Units of Measurement

The units of measurement for marginal benefit depend on the context:

- Utilitarian Units: In theoretical economics, satisfaction is often measured in hypothetical units called “utils.” While utilities are not used in real-world transactions, they help illustrate concepts like marginal benefit and marginal utility.

- Monetary Units: In practical applications, especially in business and consumer economics, marginal benefit is typically measured in monetary terms. This involves determining the maximum amount a consumer is willing to pay for an additional unit of a good or service.

For instance, if a consumer is willing to pay $5 for the first slice of pizza and $3 for the second, the marginal benefit of the second slice is $3.

Understanding these units is essential for applying the marginal benefit formula effectively and for making decisions that align with economic principles.

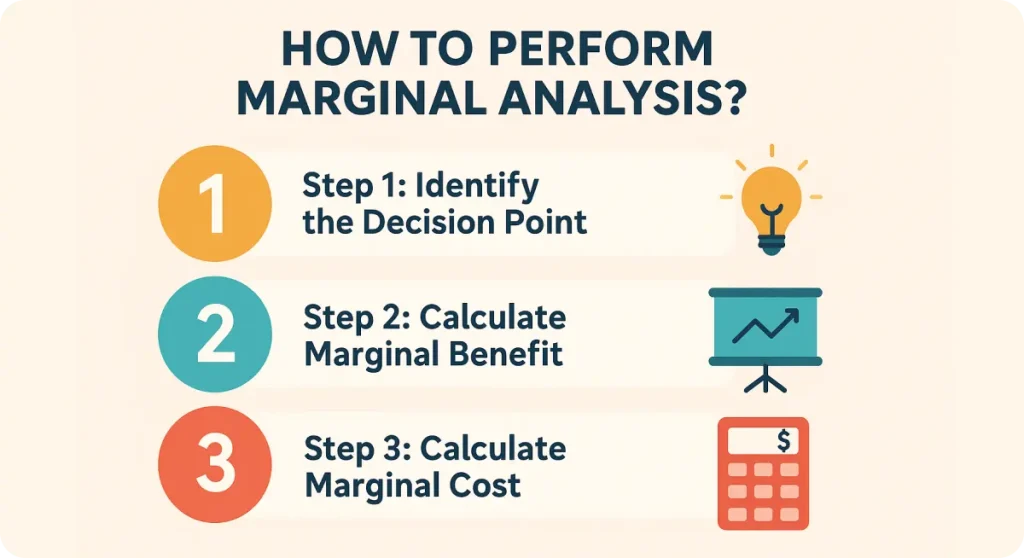

How to Calculate Marginal Benefit?

For those thinking about how to find marginal benefit and think it sounds complicated, it’s actually a straightforward process that helps you make smarter decisions in everyday life and business. In the following section, we’ll break down how to calculate marginal benefit with examples.

Step 1: Measure Total Benefit Before and After the Additional Unit

The first step in knowing how to calculate marginal benefit is to figure out the total benefit a business receives from producing or selling a certain quantity of a product or service. This benefit is typically measured in terms of marginal revenue, profit, or overall value generated.

Example:

Consider a small business selling custom-made notebooks.

Total Benefit from selling 100 notebooks: $1,000 in revenue

Total Benefit from selling 101 notebooks: $1,010 in revenue

This shows that by selling one additional notebook, the business earns an extra $10 in revenue. The total benefit increases as the business sells more units, and this additional revenue reflects the marginal benefit of that extra notebook sold.

Step 2: Calculate the Change in Total Benefit and Quantity

Next, determine the change in total benefit and the change in quantity consumed between two consumption levels.

- Change in Total Benefit (ΔTB): Subtract the total benefit before consuming the additional unit from the total benefit after consumption.

| ΔTB = Total Benefit after – Total Benefit before |

Using the previous example:

| ΔTB = 15 utils – 12 utils = 3 utils |

- Change in Quantity (ΔQ): Subtract the quantity consumed before from the quantity consumed after.

| ΔQ = Quantity after – Quantity before |

In this case:

| ΔQ = 3 slices – 2 slices = 1 slice |

Step 3: Apply the Marginal Benefit Formula

Now comes the important step in how to calculate marginal benefit. Apply the marginal benefit formula to calculate the additional satisfaction gained from consuming the extra unit.

| Marginal Benefit (MB) = ΔTotal Benefit / ΔQuantity |

Substituting the values:

| MB = 3 utils / 1 slice = 3 utils per slice |

Practical Example of Marginal Benefit

Understanding marginal benefit in business isn’t just about theory, it’s about making smarter, data-driven decisions that improve profitability and efficiency. Here are 3 detailed marginal benefit examples, presented with formulas and bullet points to help you understand how to calculate marginal benefit easily.

Example 1: Hiring One More Employee

A digital marketing agency considers expanding its workforce to take on more projects.

Scenario:

Revenue with 5 employees = $10,000/month

Revenue after hiring a 6th employee = $12,000/month

Marginal Benefit Calculation:

| MB = 12,000 – 10,000 / 6 – 5 = 2,000 / 1 = 2,000 |

The extra employee contributes $2,000 more in revenue per month. The business owner should evaluate if the employee’s salary and additional overhead (benefits, equipment) are less than $2,000. If so, hiring the employee adds real value and boosts business capacity.

Example 2: Extending Store Operating Hours

A retail store owner can understand how to calculate marginal benefits by considering staying open for an extra hour to attract more customers.

Scenario:

Sales during 8 operating hours = $5,000/day

Sales with 9 operating hours = $5,300/day

Marginal Benefit Calculation:

| MB = 5,300 – 5,000 / 9 – 8 = 300 / 1 = 300 |

The additional operating hour generates $300 in extra sales. If the combined cost of extra staff wages, electricity, and other overheads is less than $300, the owner should keep the store open longer to increase profit.

Example 3: Investing in Online Advertising

An online store is evaluating increasing its advertising budget to boost sales.

Scenario:

Sales with the current ad spend = $500/day

Sales after increasing ad spend = $550/day

Marginal Benefit Calculation:

| MB = 550 – 500 / 1 = 50 / 1 = 50 |

The additional advertising leads to $50 more in daily sales. If the extra advertising cost is $30/day, the net gain becomes $20/day, making the ad spend increase worthwhile and boosting profitability over time.

Integrating Profit Margin Insights with Marginal Benefit

Understanding marginal benefit is crucial for making informed business decisions. However, to fully grasp the financial implications of these decisions, it’s essential to also consider your profit margin. Using a profit margin calculator offers a straightforward way to assess how efficiently your business converts revenue into profit.

- Instant Profit Margin Calculations: Quickly determine your profit margins by inputting your revenue and costs, allowing you to evaluate the financial impact of each additional unit produced or sold.

- Identify Areas for Improvement: By understanding your profit margins, you can pinpoint areas where reducing costs or increasing efficiency can enhance your marginal benefit.

- Strategic Decision-Making: Use the insights gained from the calculator to make informed decisions about pricing correctly, production levels, and resource allocation, ensuring that each additional unit contributes positively to your bottom line.