Are you confident your invoicing process is working for you, and not against you? For small businesses in the U.S., accurate invoicing is vital: 55% of B2B invoices go overdue (Atradius reports), often dragging cash flow and stalling growth. On top of that, a study be Levvel Research revealed that 86% of SMEs manually enter invoice data, increasing errors and delays. This is where the need to understand the different types of invoices is perceived the most.

In this blog, we’ll explore 23 types of invoices with real-world examples and use cases, so you can choose the right format for every situation, thereby streamlining billing, reducing payment friction, and improving cash flow. So, are you ready to level up your invoicing game? Let’s delve right in.

Invoices aren’t just paperwork. They’re the lifeblood of a business’s cash flow. And as your operations grow, so do the complexities of billing.

That’s why companies, from solo consultants to mid-sized enterprises rely on different types of invoices tailored to specific situations. Here’s why this matters:

Each invoice type helps communicate the purpose, timing, and payment expectations more clearly. For example, a pro forma invoice sets upfront expectations, while a recurring invoice suits subscription-based billing type. This reduces back-and-forth and accelerates decision-making.

Certain industries and jurisdictions require specific invoice details for tax, customs, or regulatory compliance. For instance, commercial invoices are essential for cross-border shipments and customs declarations, especially for U.S. e-commerce businesses.

You should also be aware of things like the minimum wage in Washington state or tipped minimum wage in different US states to keep your business away from any kind of legal troubles.

Different invoice types help segment income and track accounts receivable effectively. A credit invoice reflects refunds or discounts, while a debit invoice corrects underbilling.

Not just that, you should also consider tracking billable hours and maintaining proper timecard records with time tracking apps like Clockdiary for accurate invoicing. This level of detail simplifies audits and improves financial accuracy.

Freelancers might need a time-based invoice, while construction companies rely on progress invoices. Tailoring invoice types ensures businesses address project-specific needs and maintain consistency with contract terms.

Using the right invoice type reduces manual intervention, automates workflows, and integrates seamlessly with accounting systems. This saves time and lowers administrative costs.

Well-structured, accurate invoices boost brand credibility. Clients are more likely to pay on time when they receive a professional invoice aligned with the services rendered.

Invoices like interim or final invoices help break large projects into manageable billing cycles, thereby improving cash flow visibility and ensuring smoother collections.

In short, invoice variety isn’t complexity, it’s control.

Invoices aren’t one-size-fits-all and using the right type of invoice can make a big difference in how smoothly your business runs. Whether you’re a freelancer billing hourly, a retailer shipping products, or a consultant requesting an upfront deposit, each scenario calls for a specific kind of invoice.

In this section, we’ll break down the most common types of invoices with examples used across industries today. You’ll learn what they’re for, when to use them, and how they help streamline your billing and cash flow.

Understanding these invoice ejemplos will empower you to invoice smarter, get paid faster, and stay organized, no matter what kind of business you run.

Standard and transaction-based 2025 invoices are the foundation of everyday business billing. These are the go-to formats used to request payments for goods sold or services rendered, clearly outlining what was provided, how much is owed, and when payment is due.

Whether you’re sending a simple invoice after completing a project or billing for a one-time product sale, these invoices ensure clarity and professionalism in every transaction.

In this section, we’ll explore the most commonly used standard invoice types, how they function, and when to use each, so you can streamline payments and maintain accurate records with ease and confidence.

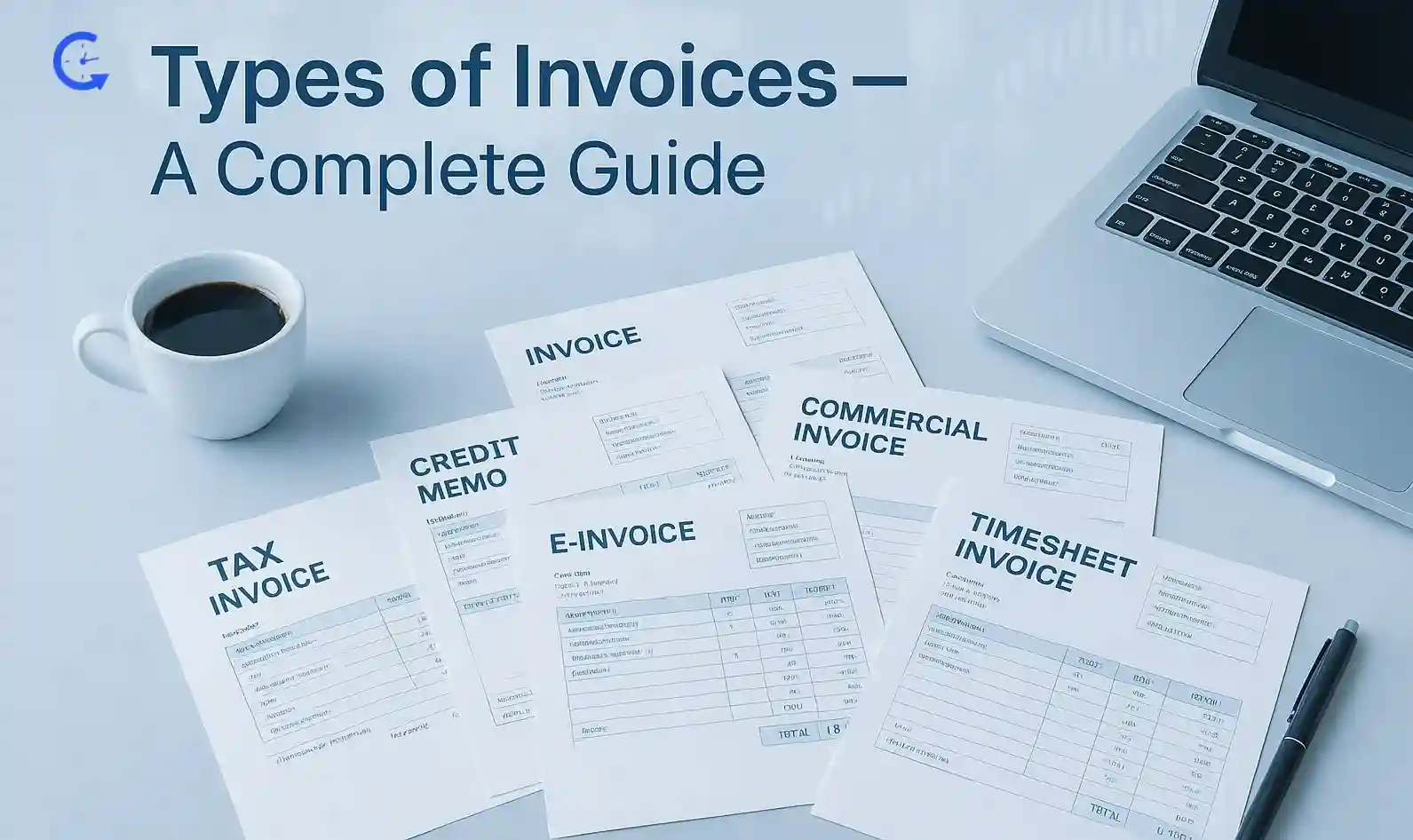

A standard invoice is the most commonly used billing and invoicing document in business. It provides a straightforward breakdown of products or services delivered, their costs, total amount due, payment terms, and contact information.

When to Use: Use a standard invoice when billing clients for completed work, one-time product sales, or general services, especially in straightforward transactions that don’t require special terms.

When to Issue: Issue these types of invoices immediately after goods have been delivered or services completed, ideally within 24–48 hours to encourage prompt payment.

Most U.S. small businesses issue standard invoices monthly or upon delivery, aligning with typical 30‑day payment terms. Shockingly, only about 36% are paid on time, with 55% arriving late, often by an average of eight days.

Who It’s Best For: Best suited for freelancers, consultants, small business owners, and service providers who need a clear, professional document to request payment.

Example: A freelance graphic designer completes a logo design for a client. They send a standard invoice listing the service (“Logo Design – 10 hours”), the hourly rate, total cost, payment due date, and accepted payment methods. Simple, clear, and ready for payment.

Download Standard Invoice Template Google Sheets

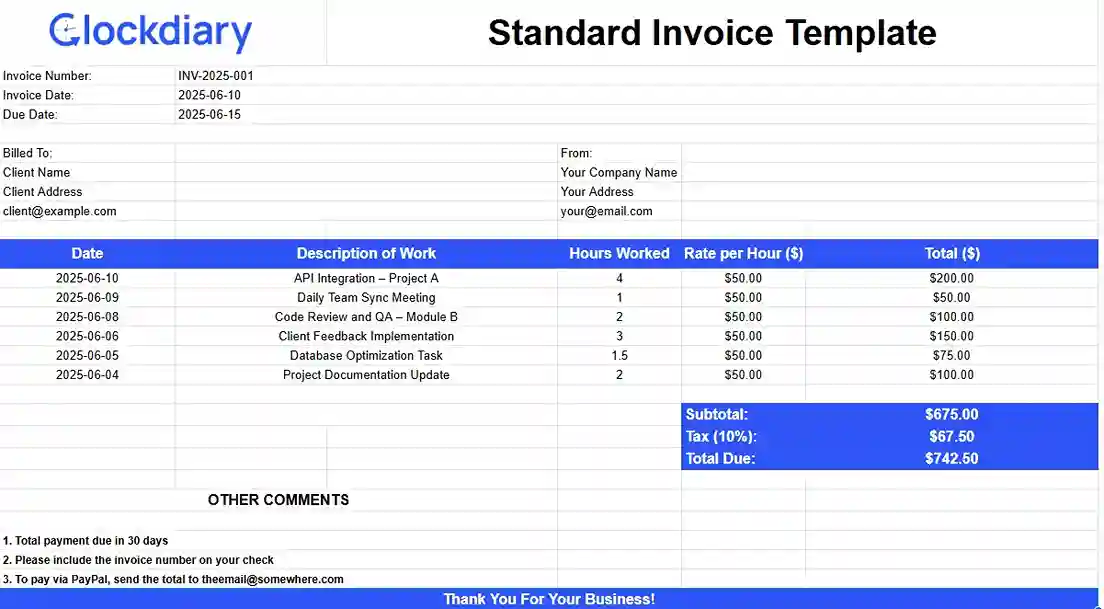

A sales invoice is a commercial document issued by a seller to a buyer after a product or service has been delivered. It confirms the transaction, outlines the items sold, quantities, prices, taxes, and the total amount due.

When to Use: Use a sales invoice when you’ve completed a sale, whether it’s a physical product or a digital item and need to request payment from the buyer.

Most U.S. small businesses process about 500 invoices monthly, with 66% spending more than five days just handling these transactions.

When to Issue: Issue these types of invoice payment immediately after the product has been shipped or delivered, especially if payment is due upon receipt or within a set credit period.

Who It’s Best For: Ideal for retailers, wholesalers, e-commerce businesses, and service providers who sell products regularly and need accurate transaction records.

Example: An online clothing store ships an order of five shirts to a customer. They generate a sales invoice showing product descriptions, quantities, unit prices, subtotal, taxes, shipping fees, and total amount payable. It’s attached to the package and sent to the customer via email.

Download Sales Invoice Template Google Sheets

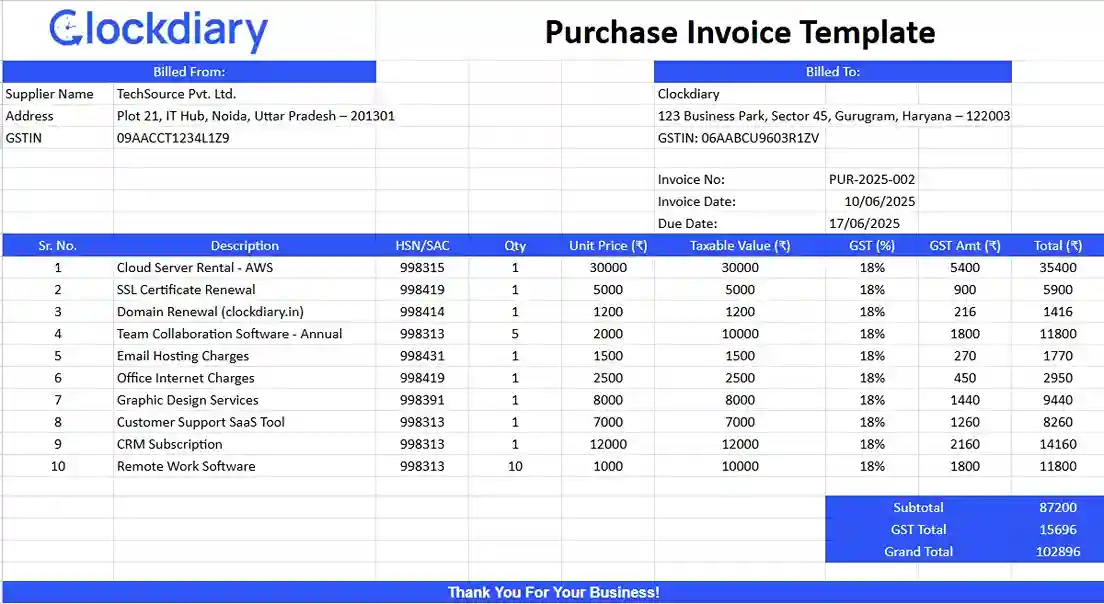

A purchase invoice is a document issued by a vendor or supplier to a buyer, confirming the sale of goods or services and the amount the buyer owes. While it looks similar to a sales invoice, it’s viewed from the buyer’s perspective as a record of an incoming purchase.

When to Use: Use a purchase invoice to record and verify purchases made for business operations, such as raw materials, office supplies, or outsourced services.

For U.S. SMEs, nearly half (48%) still rely partly on paper workflows, slowing AP processes by at least five days monthly.

When to Issue: Vendors issue purchase invoices at the time of delivery or shortly after, and buyers record them upon receipt for accounts payable tracking.

Who It’s Best for: These types of invoices are essential for procurement professionals, operations managers, accountants, and any business that regularly sources goods or services from suppliers.

Example: A restaurant orders bulk ingredients from a food supplier. When the goods are delivered, the supplier issues a purchase invoice detailing the items, quantities, and total cost. The restaurant uses this invoice to update inventory and schedule payment.

Download Purchase Invoice Template Google Sheets

An overdue invoice, also known as past due invoice, is a previously issued invoice that hasn’t been paid by its due date. These forms of invoice serve as a reminder to the client that payment is past due and typically includes late fees or updated payment terms if applicable.

When to Use: Use an overdue invoice when a client fails to pay the original invoice within the agreed timeframe—often 15, 30, or 60 days past due, depending on your payment terms.

When to Issue: Issue these types of invoices in accounts receivable as soon as the original invoice becomes overdue. Follow up promptly to encourage payment and maintain cash flow.

In the U.S., 55% of B2B invoices are paid late, averaging 8 days past due, costing small businesses around 10% of their workweek spent chasing payments.

Who It’s Best for: Useful for freelancers, service providers, small businesses, and finance teams managing accounts receivable. This example of business invoice helps maintain professionalism while asserting the need for timely payment.

Example: A consultant completes a project and sends an invoice with 30-day payment terms. After 35 days with no payment, they send an overdue invoice with a polite reminder and a 2% late fee added.

Download Overdue Invoice Template Google Sheets

A recurring invoice is an automated invoice sent at regular intervals—weekly, monthly, or quarterly for ongoing products or services. It ensures consistent billing without manual effort each time.

When to Use: Use a recurring invoice when you provide subscription-based services, retainers, maintenance contracts, or ongoing support that requires predictable, repeat billing.

When to Issue: Set it to be issued on a predefined schedule (e.g., the 1st of every month). Automation tools or invoicing software like Clockdiary can help streamline this process and reduce errors.

Who It’s Best for: These types of invoice are ideal for SaaS companies, consultants on retainer, digital marketers, IT support providers, and any business offering long-term services with fixed pricing.

Example: A digital marketing agency manages a client’s SEO and social media monthly. Instead of manually billing each time, they set up a recurring invoice for $1,500/month, automatically sent on the first day of every month with consistent details and payment terms.

Download Recurring Invoice Template Google Sheets

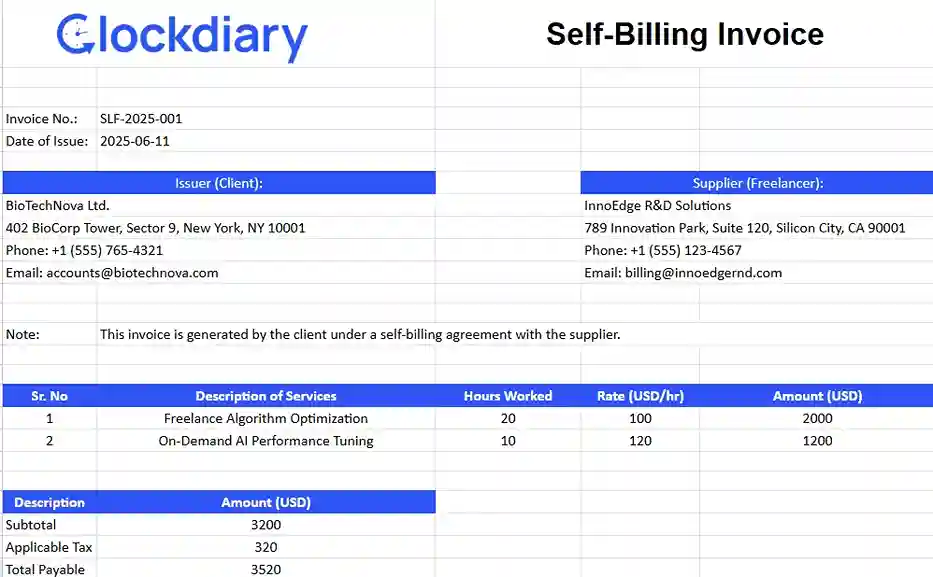

A self-billing invoice is created by the buyer, not the seller. It’s a special invoicing arrangement where the buyer prepares the invoice on behalf of the supplier and sends it for confirmation and record-keeping.

Both parties must agree in advance to this method, usually through a self-billing agreement. According to APQC, about 7–10% of supplier invoices globally use self‑billing systems.

When to Use: Use a self-billing invoice when there’s an ongoing relationship where the buyer has more control or visibility over the transaction details, such as in consignment or volume-based purchasing.

When to Issue: Issue these types of invoices immediately after the goods or services are received, based on the pre-agreed terms between the buyer and supplier.

Who It’s Best for: Commonly used in large-scale procurement, e-commerce marketplaces, and industries like logistics or publishing where many small vendors supply one large buyer.

Example: An online marketplace like Amazon calculates earnings for a third-party seller and issues a self-billing invoice summarizing the week’s sales, commissions, and the net payout.

Download Self-Billing invoice Google Sheets

An account statement invoice is a consolidated summary of all outstanding invoices, payments, and account activity between a buyer and seller over a set period, typically a month. These types of invoices in accounting help businesses track multiple transactions with a client in one place.

When to Use: Use it when managing multiple invoices for a single customer, especially in ongoing B2B relationships. It’s ideal for reminding clients of unpaid balances or providing a monthly transaction overview.

This might come to you as a surprise but over 40% of B2B companies send monthly statements to proactively remind clients of outstanding balances.

When to Issue: Issue it at the end of a billing cycle (monthly or quarterly), or when reconciling multiple open invoices with a client to prompt bulk payment.

Who It’s Best for: Best suited for wholesalers, service-based businesses, and finance teams handling multiple transactions with regular clients.

Example: A wholesaler supplies products weekly to a retail store. At the end of the month, they send an account statement invoice listing all sales, payments received, and the total outstanding amount, helping streamline reconciliation and payment.

Download Account Statement Invoice Template Google Sheets

Project-based invoices are designed for work that’s delivered over time, in phases, or based on specific milestones. Unlike standard one-time invoices, these invoices for business align with how project-based businesses operate, offering more flexibility, transparency, and control over cash flow.

Whether you’re a consultant, agency, contractor, or freelancer, project-based invoices help you get paid at key points during a project’s lifecycle. In this section, we’ll cover the most common types of project-based invoices, when to use them, and how they support better client relationships and financial planning.

If your work revolves around deliverables and timelines, these invoice types are absolutely essential.

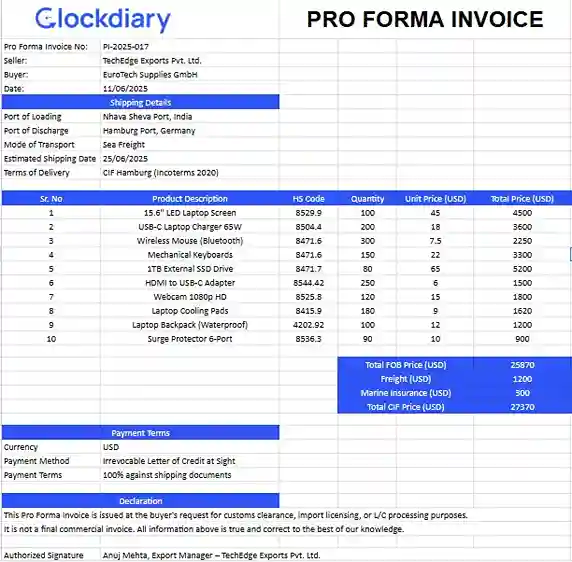

A pro forma invoice is a preliminary bill or estimate sent to a buyer before goods or services are delivered. It outlines the expected costs, scope of work, and terms, serving as a quote rather than a demand for payment.

When to Use: Use a pro forma invoice when clients request a detailed cost breakdown before committing, or when required for approval, budgeting, or import/export purposes.

When to Issue: Issue these types of invoice before the transaction begins, typically during the negotiation or quoting stage, so the buyer can review and approve the terms before moving forward.

Who It’s Best for: Ideal for service providers, consultants, manufacturers, exporters, and any business that deals with custom orders or international clients requiring documentation for customs clearance.

Example: A U.S.-based furniture manufacturer receives an international order. Before shipping, they send the client a pro forma invoice detailing item descriptions, prices, shipping fees, and estimated taxes for customs review and prepayment.

Download Pro Forma Invoice Template Google Sheets

An interim invoice is a partial bill issued at various stages of a long-term project. It allows businesses to collect payments incrementally instead of waiting until the entire project is complete, improving cash flow and financial stability throughout the project timeline.

When to Use: Use interim invoices during multi-phase or long-duration projects where expenses are incurred over time. It ensures both parties stay financially aligned throughout the engagement.

Construction, IT, and consulting sectors often do so, especially since 51% of suppliers report late payments, making interim billing crucial for maintaining consistent cash flow.

When to Issue: Issue these types of invoices at key milestones, such as after completing specific deliverables, monthly progress, or pre-agreed intervals set in the contract.

Who It’s Best for: Best suited for contractors, consultants, construction firms, creative agencies, and freelancers working on complex or high-value projects that span weeks or months.

Example: A web development agency is building a custom e-commerce platform. They issue interim invoices after completing the design phase, again after development, and once more before launch. helping the client manage payments and the agency maintain steady cash flow.

Download Interim Invoice Template Google Sheets

A retainer invoice is used to request upfront payment for future services, often on a recurring basis. It secures the service provider’s availability and reserves time or resources for a client in advance.

These types of invoice are tied to a retainer agreement outlining the scope, duration, and terms.

When to Use: Use a retainer invoice when you provide ongoing or on-call services and want to guarantee payment ahead of time, especially for long-term client relationships.

When to Issue: Issue it before the work begins—monthly, quarterly, or per project, based on the terms of the retainer agreement.

According to a 2025 study, only 13% of consultants leverage monthly retainers, but among those who do, 1–20% of client work falls under retainer agreements, with smaller firms averaging 29%.

Who It’s Best for: Ideal for legal professionals, consultants, marketing agencies, IT support teams, and creative freelancers who offer continuous support or advisory services.

Example: A business coach charges a client $2,000 monthly for four sessions and unlimited email support. They issue a retainer invoice at the start of each month to secure their time and commitment in advance.

Download Retainer Invoice Template Google Sheets

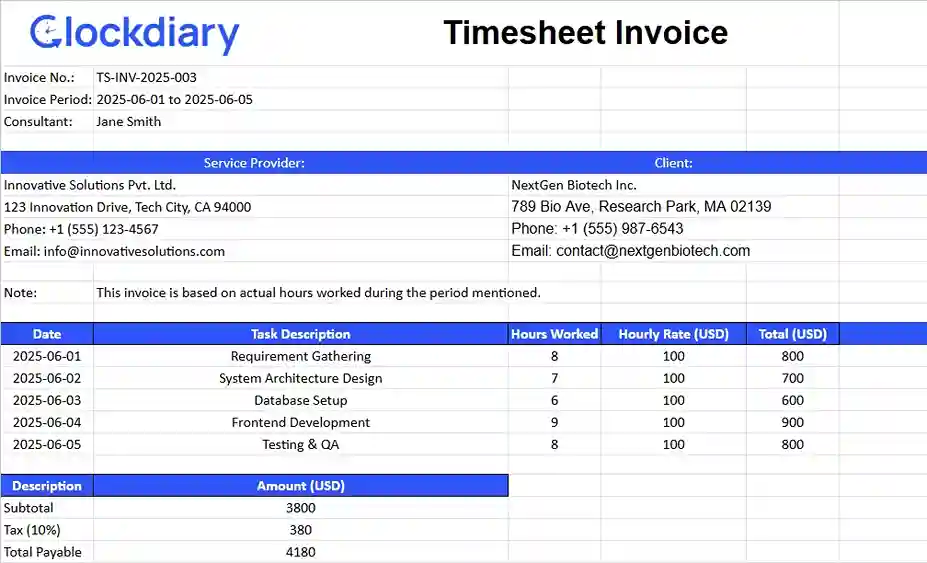

A timesheet invoice is a billing document based on hours worked, usually accompanied by a detailed log of time entries. It calculates payment by multiplying the number of working hours by an agreed hourly rate, ensuring transparency between service provider and client.

When to Use: Use a timesheet invoice when billing for hourly or daily work, especially when the project scope is flexible or tasks vary over time.

When to Issue: Issue these types of invoices at the end of a billing cycle—weekly, bi-weekly, or monthly, once the timesheet has been completed and approved.

Who It’s Best for: Ideal for freelancers, consultants, contractors, virtual assistants, and agencies that bill by the hour for professional services like design, development, coaching, or writing.

Example: A freelance UX designer tracks 25 hours of work for a client over two weeks using Clockdiary timesheet software. They submit a timesheet invoice showing dates, tasks, hours logged, and their hourly rate of $80, resulting in a $ (25 x 80) = $2,000 invoice sent for approval and payment.

Download Timesheet Invoice Template Google Sheets

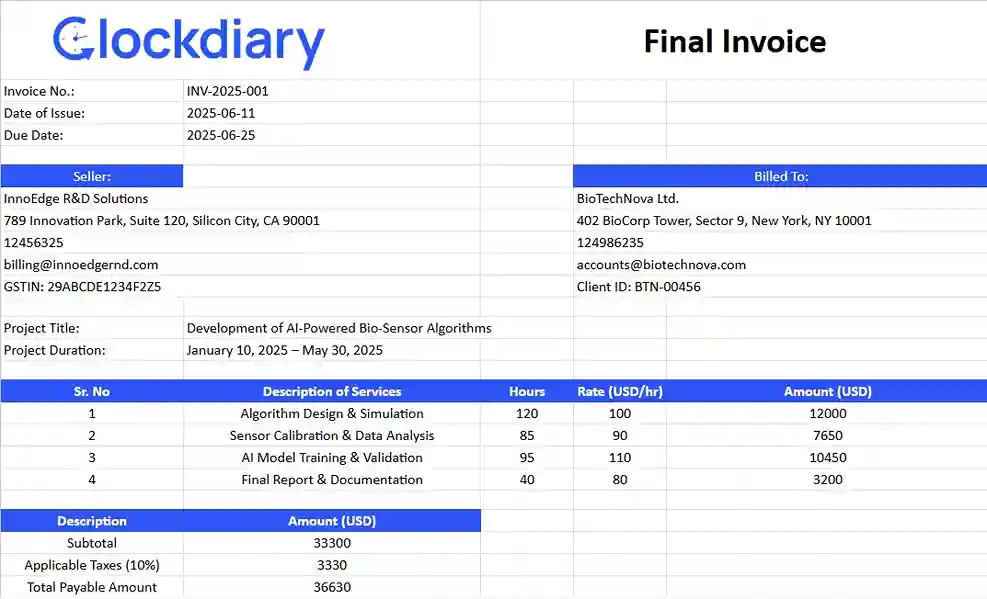

A final invoice is the last bill sent to a client at the completion of a project or after all goods and services have been delivered. It includes the total amount due, minus any previous payments or deposits, and officially closes out the transaction.

When to Use: Use a final invoice after completing all agreed-upon work, especially when the project involved earlier interim or retainer invoices. It confirms that the contract is fulfilled and payment is now due in full.

When to Issue: Issue final invoices immediately upon project completion or final delivery, once the client has approved all deliverables.

For project-based freelancers and small businesses, final invoices bring closure, yet only about 36% of U.S. invoices are paid on time, making a clear final invoice crucial for prompt payment.

Who It’s Best for: Perfect for freelancers, consultants, agencies, and service providers managing multi-stage projects or contract-based work.

Example: A marketing agency completes a six-month campaign for a client. After sending monthly interim invoices, they issue a final invoice with the remaining balance of $1,500, clearly labeled as the final bill to wrap up the engagement.

Download Final Invoice Template Google Sheets

A collective or consolidated invoice combines multiple transactions, orders, or deliveries for the same client into a single billing document. These types of invoices in logistics simplify invoicing by reducing paperwork and helping both parties manage payments more efficiently.

When to Use: Use a consolidated invoice when you’ve completed multiple jobs or deliveries for the same client within a billing period and prefer to invoice them all at once.

Most U.S. businesses process over 500 invoices monthly, often spending five days or more just managing them. Consolidating those into a single invoice simplifies tracking and accelerates payment.

When to Issue: Issue it at the end of a defined billing cycle—weekly, bi-weekly, or monthly, summarizing all completed work or shipments during that time.

Who It’s Best for: Ideal for wholesalers, agencies, freelancers, and service providers who perform recurring work or ship products regularly to the same client.

Example: A logistics company delivers goods to a retail chain multiple times in a month. Instead of sending separate invoices for each delivery, they issue a consolidated invoice listing all deliveries, quantities, and total charges, making payment and reconciliation easier for both sides.

Download Collective / Consolidated Invoice Template

Not every invoice is about charging for new work. Some are issued to correct, adjust, or credit past transactions. Adjustment and memo invoices play a critical role in keeping financial records accurate and transparent.

These specialized invoice types are used to handle situations like billing errors, product returns, price changes, or discounts after the original invoice was issued. They help businesses maintain professional relationships and ensure compliance with accounting standards.

In this section, we’ll explore the key types of adjustment and memo invoices, when to use them, and how they support clean bookkeeping and smooth client communication.

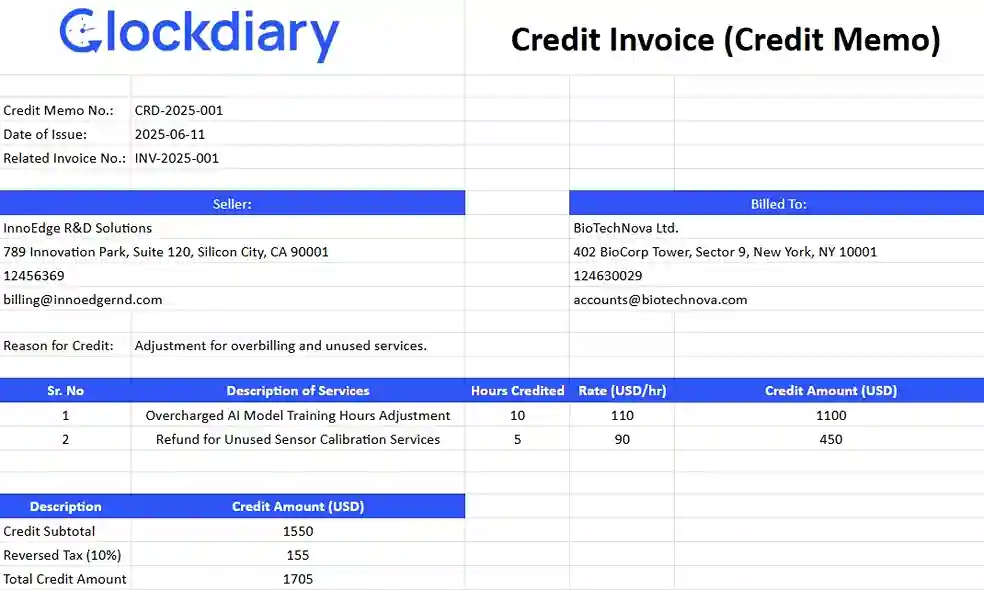

A credit invoice, also known as a credit memo, is issued when a seller needs to reduce or cancel all or part of a previously issued invoice. This type of invoice in accounting reflects a negative amount and are used to adjust the customer’s account balance.

When to Use: Use a credit invoice when a client returns products, overpays, cancels a service, or qualifies for a discount or refund after the original invoice was sent.

When to Issue: Issue it as soon as the reason for the adjustment is confirmed, such as returned goods, agreed-upon refunds, or pricing corrections.

Prompt issuance ensures transparency and trust. Critical given that U.S. small businesses lose an estimated $39,000/year to late or incorrect invoicing.

Who It’s Best for: Best for retailers, wholesalers, service providers, or any business needing to correct billing errors or account for returns and post-sale adjustments.

Example: A retailer invoices a customer for 100 units, but the customer returns 10 due to defects. The seller issues a credit invoice for those 10 units, reducing the total amount owed accordingly.

Download Credit Invoice (Credit Memo) Template Google Sheets

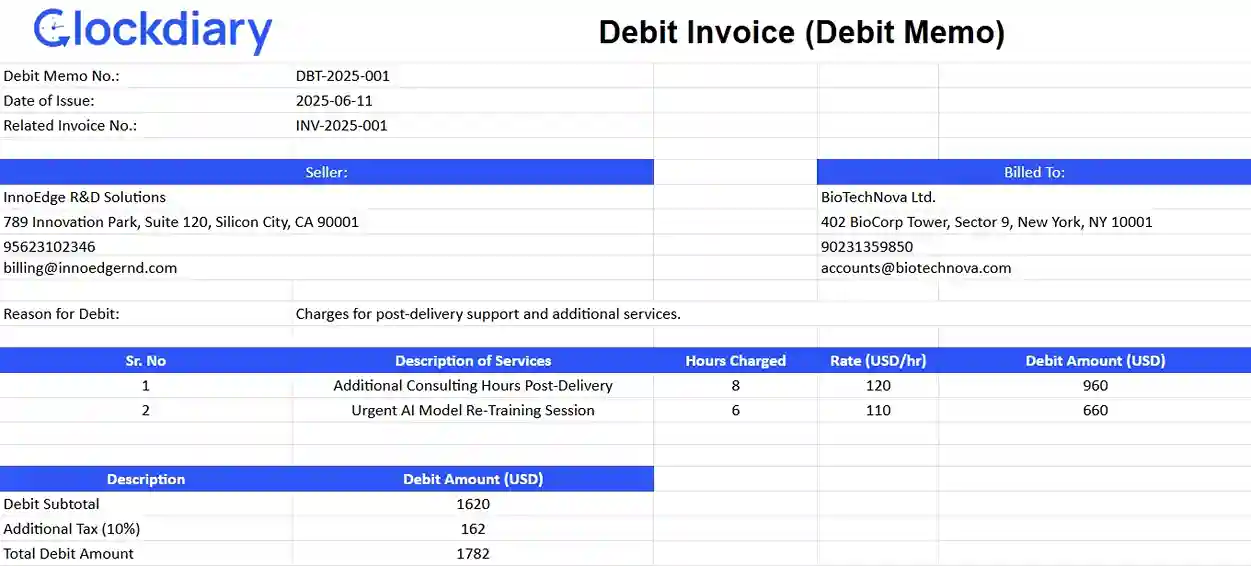

A debit invoice, also known as a debit memo, is issued by a seller to increase the amount a customer owes, usually due to underbilling, price adjustments, or additional charges not included in the original invoice.

Unlike a standard invoice, it references an existing transaction and adds to the balance.

When to Use: Use a debit memo when you’ve accidentally undercharged, need to bill for extra services, or there’s a pricing change after the original invoice was sent.

When to Issue: Issue it as soon as the discrepancy is discovered or the additional charge is agreed upon with the client.

Who It’s Best for: These types of invoices in accounts receivable are useful for businesses that provide flexible services or deal with post-sale adjustments, such as consultants, agencies, SaaS providers, and suppliers.

Example: A consulting firm completes extra strategy sessions for a client that weren’t part of the original agreement. They issue a debit memo for the additional $500 due, which is added to the client’s outstanding balance.

Download Debit Invoice (Debit Memo) Template Google Sheets

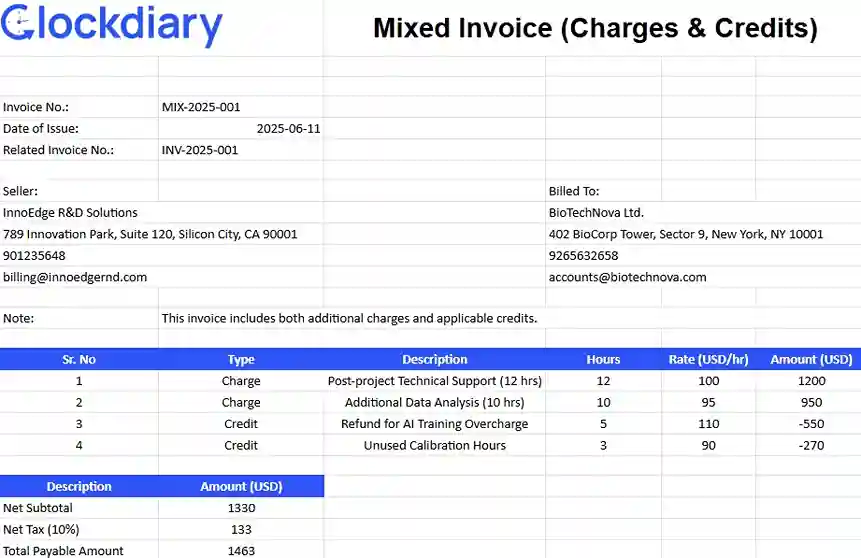

A mixed invoice includes both charges (debits) and credits in a single document. It’s used when a transaction involves multiple adjustments, like new purchases alongside returns or discounts, allowing both positive and negative amounts to be reflected in one invoice.

These types of invoices in accounts payable create a clear, consolidated view of the net amount owed.

When to Use: Use a mixed invoice when a client has made new purchases but also qualifies for returns, discounts, or previous overpayments in the same billing cycle.

When to Issue: Issue it during the regular billing cycle or at the point of transaction reconciliation, especially when dealing with adjustments to a customer’s account.

Who It’s Best for: Ideal for wholesalers, retailers, subscription businesses, and service providers with frequent order changes, returns, or bundled services.

Example: A wholesale supplier ships new inventory worth $1,000 but receives a $200 return from the previous order. They issue a mixed invoice showing $1,000 in charges and a $200 credit, with a net payable of $800.

Download Mixed Invoice Template Google Sheets

In today’s global business landscape, invoicing isn’t just about getting paid. It’s also about staying compliant with tax regulations and international trade laws. Compliance and international invoices are specifically designed to meet legal, regulatory, and cross-border requirements.

Whether you’re dealing with government contracts, cross-border shipping, or tax reporting, these specialized invoices ensure your transactions remain accurate, auditable, and penalty-free. From tax-compliant formats to customs-ready documentation, these types of invoices are essential for businesses operating in highly regulated industries or across international markets.

With global B2B e-commerce expected to surpass $20 trillion by 2027, understanding how to issue compliant, internationally accepted invoices is more vital than ever. In this section, we’ll explore key invoice types that help you stay compliant while conducting domestic and international business.

A commercial invoice is a mandatory customs and financial document used in international trade. U.S. Customs and Border Protection requires one for each shipment, detailing the value, HS codes, origin, and terms of sale.

When to Use: Every time you export goods, regardless of value, use a commercial invoice. It’s essential for customs duty calculation, tax assessment, and clearance procedures .

When to Issue: Issue these types of invoices as soon as goods are ready for export, accompanying the shipment. U.S. import rules generally require three copies for various stakeholders (exporter, importer, carrier) .

Who It’s Best For: Ideal for e-commerce sellers, manufacturers, international traders, including SMEs and growing U.S. exporters, navigating customs, trade compliance, and global logistics.

Example: A California-based artisanal soap maker exports a $5,000 shipment to the EU. They issue a commercial invoice listing HS codes, unit value, weight, Incoterms, and origin, aiding EU customs in duty calculation and clearance.

Download Commercial Invoice Template Google Sheets

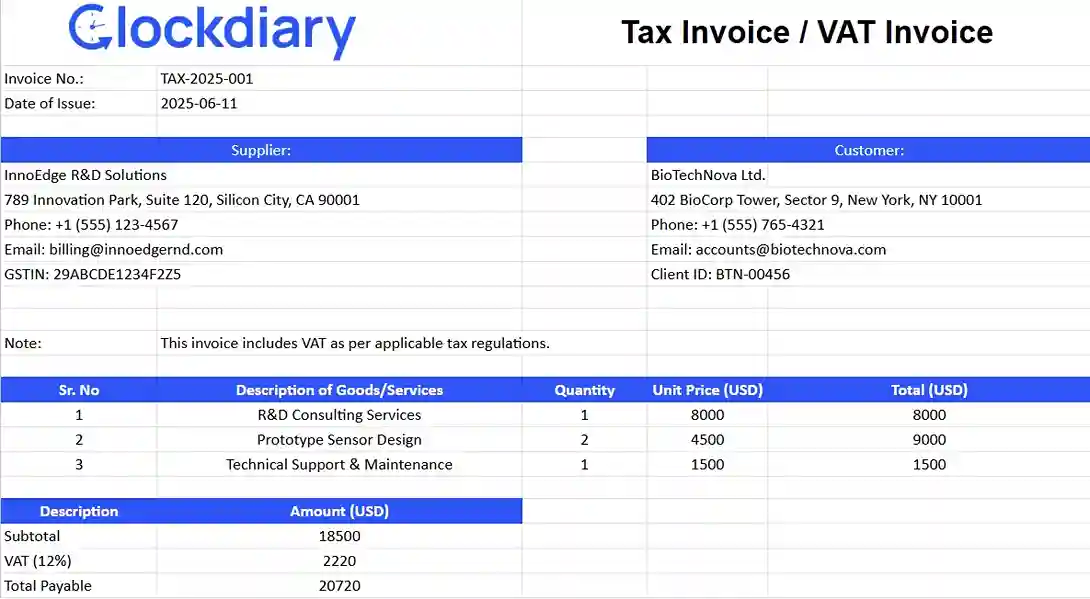

A VAT (Value‑Added Tax) or tax invoice is a legally required document issued by VAT‑registered sellers. These invoices for businesses detail taxable goods/services, VAT rate charged, and VAT registration numbers, crucial for compliance.

When to Use: Use VAT invoices for B2B or B2C taxable transactions in VAT‑implementing countries (170+ globally). Over 20% of global tax revenue comes from VAT, underscoring their importance.

When to Issue: Issue a VAT invoice within 30 days of supply or upon receipt of payment. Detailed tax point rules vary by country, but prompt issuance improves compliance and cash flow management.

Who It’s Best For: Essential for international businesses—e-commerce, exporters, service providers, especially U.S. companies selling to EU/UK clients needing input‑tax documentation .

Example: A U.S. software vendor selling a €5,000 subscription to an EU firm issues a VAT invoice detailing supplier VAT number, net value, VAT rate (e.g., 20%), VAT charged, and total gross amount, enabling the buyer to reclaim input VAT.

Download VAT / Tax Invoice Template Google Sheets

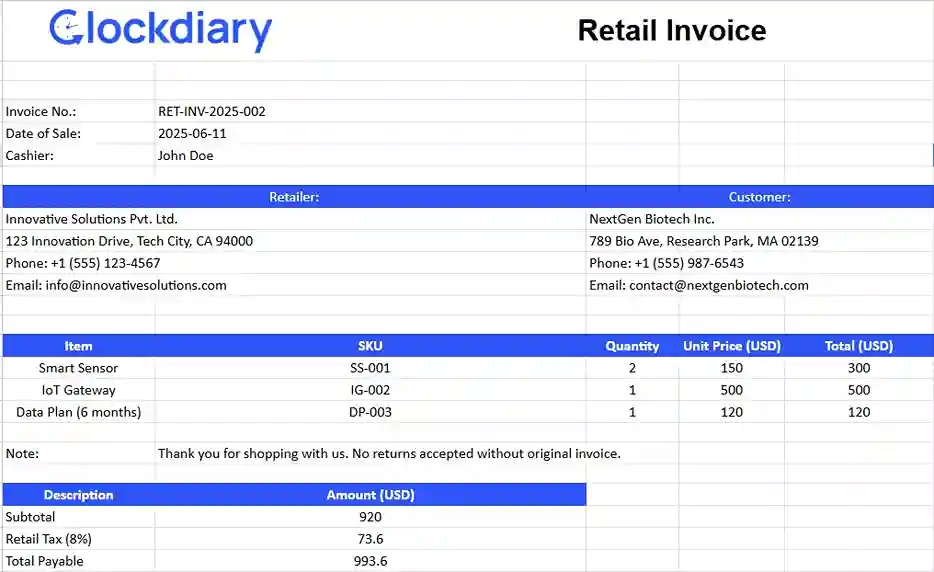

A retail invoice is a point-of-sale receipt given to consumers at the time of purchase, detailing items bought, prices, taxes, payment method, and often store info. It functions as both proof of purchase and financial record.

When to Use: Use retail invoices for everyday in-store or online transactions. With roughly 89% of U.S. consumers wanting digital receipt options, many retailers now offer e-receipts alongside traditional paper ones.

When to Issue: Issue these types of invoices immediately at checkout, whether via printed receipt or emailed digital copy. Speed is essential: 45% of shoppers expect instant digital receipts after purchase.

Who It’s Best For: Ideal for retailers, e-commerce stores, restaurants, and service businesses delivering direct-to-consumer (D2C) products or experiences.

Example: A boutique in New York sells a $150 dress. At checkout, the POS prints a detailed receipt and emails a digital copy, complete with itemized costs, tax, payment method, loyalty points, and a link to join the store’s mailing list.

Download Retail Invoice Template Google Sheets

An expense report invoice is a detailed, itemized document employees submit to a business for reimbursement, recording everything from travel and meals to office supplies.

When to Use: Use these invoice types when team members spend personal funds on business-related items. With 75% of companies now using mobile T&E apps for reporting, manual logs are fading fast.

When to Issue: Employees typically submit reports weekly or monthly, or after trips. QuickBooks notes that reimbursing within the same month streamlines accounting and ensures tax compliance .

Who It’s Best for: Ideal for freelancers, remote workers, SMBs, and consultants who need to track job-related expenses and claim legitimate business deductions.

Example: A consultant travels to Chicago for meetings, incurring $800 in meals, taxi rides, and lodging. They submit an expense report with digital receipts via a mobile app, and the finance team reimburses within ten days, maintaining clean books and steady cash flow.

Download Expense Report Invoice Template Google Sheets

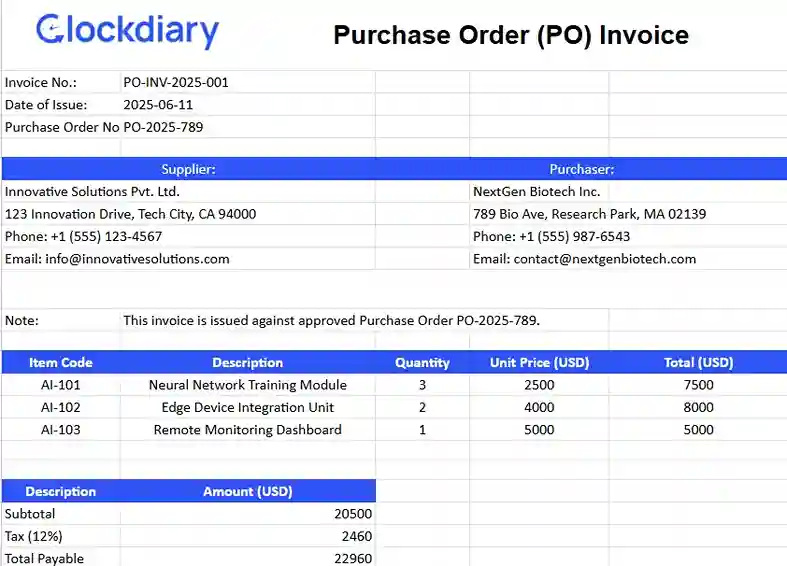

A PO invoice is created by a seller referencing a buyer-issued purchase order (PO), matching agreed-upon items, pricing, and quantities before requesting payment.

When to Use: Use a PO invoice when procurement policies require formal approval before purchasing, common in mid-sized US businesses and enterprises. Around 86% of SMEs still manually enter invoice data, increasing mismatch risk. Matched PO invoices help eliminate that.

When to Issue: Issue these types of invoices in accounts payable once goods or services are delivered and verified against the PO. This ensures the invoice aligns with internal approvals and facilitates faster payment processing .

Who It’s Best For: Ideal for mid-market companies, procurement-driven SMBs, manufacturers, and distributors that rely on structured order approvals and three-way matching (PO, delivery, invoice).

Example: A tech startup issues a PO for $5,000 of cloud services. After delivery, the vendor sends a PO invoice quoting the PO number, matching deliverables and cost, fast-tracking accounts payable with clear documentation.

Download PO (Purchase Order) Invoice Template Google Sheets

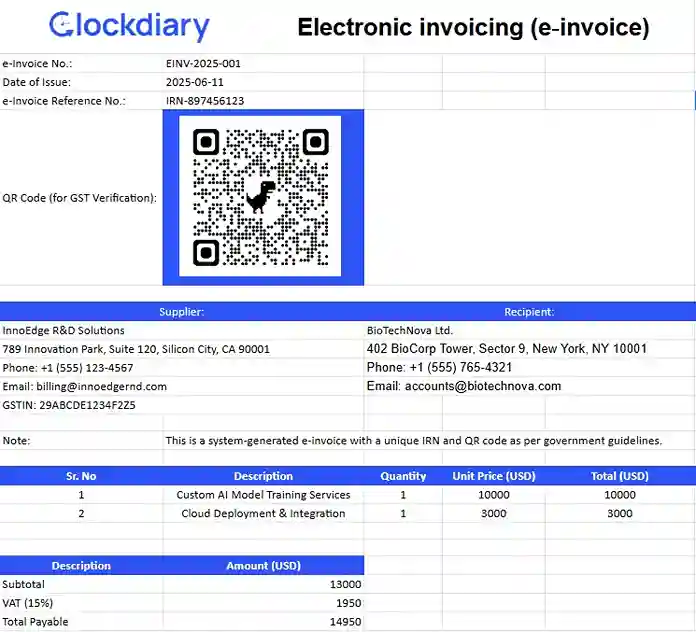

In a world where speed, compliance, and automation are everything, e-invoicing is no longer optional. Rather, it’s essential. Electronic invoicing (or e-invoicing) enables businesses to generate, send, receive, and process invoices digitally, improving accuracy and efficiency.

According to the U.S. Department of Treasury, digital invoicing adoption is growing rapidly, with over 65% of U.S. businesses shifting to paperless billing systems.

Whether you’re a small business owner, a finance leader, or an e-commerce seller, understanding different digital invoice formats helps you stay compliant, reduce delays, and boost cash flow. Let’s explore the key types of invoices digital and use cases driving this shift.

An e‑invoice is a structured, machine-readable digital invoice, sent directly from seller to buyer systems (e.g., via XML or EDI), not just a scanned PDF .

When to Use: Ideal when automating invoice creation and processing. For example, when exchanging invoices within ERP systems or national e‑invoicing networks. In the U.S., around 25% of B2B invoices now meet true e‑invoice standards.

When to Issue: Issue these types of billing at delivery or service completion, transmitting it directly into the buyer’s system. This enables real-time validation and accelerates “straight-through processing” .

Who It’s Best For: Best for mid-sized and large businesses, especially those with federal agency clients; about 74 U.S. federal agencies now require e-invoicing for vendor invoices.

Example: A U.S. manufacturing firm delivers 1,000 units to a federal department, issues an XML-based e-invoice matching the PO, and it’s automatically validated and paid, cutting manual intervention by 50% and slashing processing time by nearly two weeks.

Download Electronic Invoicing (e-Invoice) Template Google Sheets

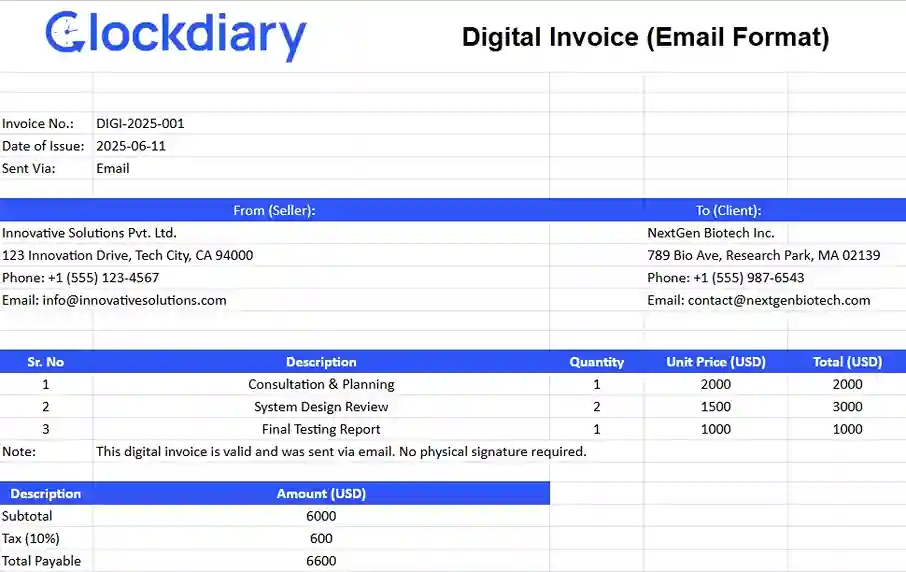

A digital invoice is a digitally sent invoice, typically a PDF, Word, or image file delivered via email or an online portal. Unlike structured e‑invoices, it’s designed primarily for viewing, not automated processing.

When to Use: Perfect for small businesses and freelancers transitioning from paper to basic digital billing. As of 2019, only 38% of U.S. businesses used any form of electronic invoicing. But usage of digital (PDF‑style) invoices has surged during the post‑COVID shift to remote operations .

When to Issue: Issue these types of invoices immediately upon service completion or product delivery by attaching the invoice to an email or uploading it via a client portal. Speed and convenience help reinforce professionalism.

Who It’s Best For: Ideal for small-to-mid‑size firms, consultants, and e‑commerce sellers who need quick, human‑legible invoices without investing in structured e‑invoicing systems.

Example: A freelance web developer completes a website redesign and sends a polished PDF invoice via email within hours—clearly formatted, branded, and ready for client approval, simplifying the billing process without advanced integration.

Download Digital Invoice Template Google Sheets

Choosing the right type of invoice isn’t just about sending a bill. Rather, it’s about aligning your invoicing strategy with your business model, client expectations, and regulatory requirements. Here’s how to do it effectively:

Start by familiarizing yourself with the various types of invoices—standard, sales, recurring, pro forma, credit, retainer, and more. Each serves a unique purpose, from straightforward billing to project-based or compliance-driven documentation.

Your invoice format should reflect how you do business:

Finally, ensure your invoice type complies with local and international regulations. E-invoices may be mandatory in some countries, and tax authorities may require specific data formats.

Always include essential elements like tax IDs, PO numbers, and terms to stay audit-ready.

Selecting the right invoice type streamlines payments, builds trust, and keeps your finances compliant and organized.

Clockdiary is an AI-powered time tracking and timesheet tool that simplifies invoicing for every business type, whether you’re billing hourly, tracking expenses, managing ongoing clients, handling international billing, or correcting past invoices.

Here’s how this clock in clock out app features support seamless invoicing:

Clockdiary time-tracking app takes the headache out of invoicing by turning tracked time and expenses into accurate, professional invoices customized for any scenario. From freelancers and agencies to operations teams and finance leaders, it delivers transparency, automation, and results-driven billing across the board.

So, what are you waiting for? Get in touch with us to make this supremely engineered software an integral part of your organization and let us take care of the invoicing while you focus on critical business tasks.

Frequently Asked Questions About Types of Invoices

In accounting, invoices are official documents issued by a seller to request payment from a buyer for goods or services provided. They serve as critical records for tracking revenue, managing accounts receivable, and ensuring accurate financial reporting and compliance.

3-way invoicing is a verification process that matches three key documents—the purchase order, the goods receipt, and the supplier’s invoice to ensure accuracy before payment is approved. This method helps prevent overbilling, fraud, and discrepancies in quantity or pricing, making it a standard practice in procurement and accounts payable workflows.

The three key types of project-based invoices are proforma, interim, and final invoices. A proforma invoice is a preliminary estimate sent before work begins, an interim invoice is used to bill for progress in phases, and a final invoice is issued upon project completion to request the remaining payment.

The two types of invoices on hold are payment hold invoices and approval hold invoices. A payment hold occurs when an invoice is flagged due to payment issues like mismatched totals or missing information, while an approval hold happens when the invoice requires managerial or departmental authorization before processing.

The different types of receipt invoices include cash receipts, credit card receipts, advance payment receipts, and acknowledgment receipts. Each type serves to confirm payment in various transaction scenarios, whether full, partial, or advance, and acts as proof of purchase for both the buyer and seller.