Are you confident that your business is compliant with the latest tipped minimum wage laws? As of 2025, tipped minimum pay varies significantly across the U.S., with states like California and Washington requiring employers to pay the full state minimum wage without tip credits, while others permit lower base wages supplemented by tips. For instance, the tipped minimum wage Florida is set at $9.98 per hour, increasing to $10.98 on September 30, 2025.

This comprehensive guide breaks down the 2025 tipped minimum pay rates by state, providing essential information for employers, employees, and HR professionals to ensure compliance and fair compensation. But, before we move on to the state-by-state analysis, let’s try to understand tipped minimum wage meaning in the next section. So, let’s delve right in.

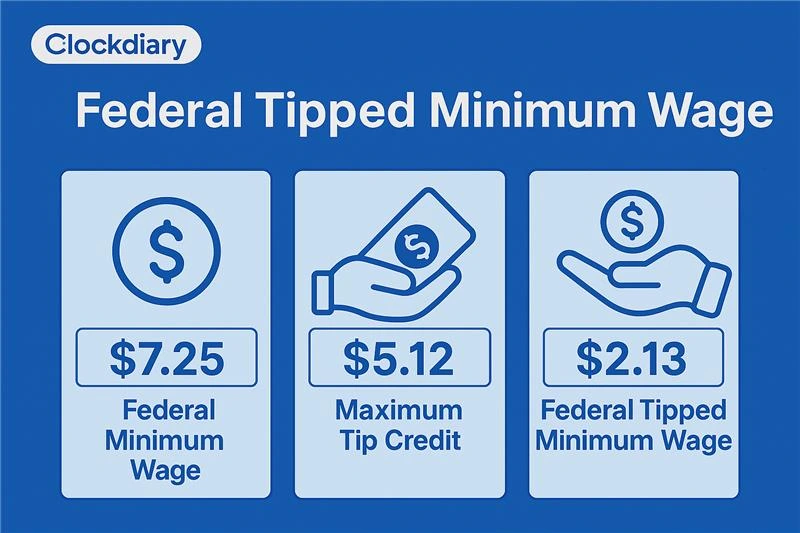

Tipped minimum wage is the base hourly rate employers can pay tipped employees—like servers, bartenders, and hotel staff—who regularly earn a certain amount in tips. Under federal law in 2025, the tipped minimum pay remains $2.13 per hour, as long as an employee’s tips bring their total earnings up to at least the federal minimum wage of $7.25.

However, many states have their own laws that set higher standards or eliminate tip credits entirely. Understanding these differences is crucial for compliance and payroll accuracy—especially for employers in hospitality and service industries where tipping is a primary income source.

Tip credit is a provision under the Fair Labor Standards Act (FLSA) that allows employers to count a portion of an employee’s tips toward meeting the required minimum wage. Instead of paying the full minimum wage directly, employers can pay a lower base wage—known as the tipped minimum wage—and use the employee’s tips to “credit” the difference.

For example, under federal law in 2025, employers may pay tipped workers $2.13/hour, using up to $5.12 in tips to reach the $7.25 minimum wage. However, states may set stricter rules or ban tip credits altogether, so compliance varies by location. A crystal clear idea of net vs gross pay would be of great help here.

Under federal law, a tip is a voluntary sum of money that a customer gives to an employee as a gift or reward for good service. To qualify as a tip, it must be freely given by the customer and not dictated or required by the employer. Tips can include cash left on the table, tips added to credit card payments, and tip-outs from pooled arrangements.

However, mandatory service charges or automatic gratuities (e.g., for large parties) are not considered tips—they’re treated as regular wages. For a payment to be legally classified as a tip, the customer must have full discretion over the amount.

As of 2025, the federal tipped minimum wage remains $2.13 per hour. Employers can use a tip credit to pay this lower rate only if an employee’s tips bring their total earnings to at least the federal minimum wage of $7.25 per hour.

Example Calculation:

If a server works 5 hours, they must earn:

| 5 × $7.25 = $36.25 total (federal minimum wage requirement) |

If the employer pays 5 × $2.13 = $10.65 in base wage, the server must earn at least $36.25 – $10.65 = $25.60 in tips during that shift to meet the law.

If the tips fall short, the employer must make up the difference.

However, many states have set higher tipped wages or eliminated the tip credit entirely, making it essential to know local laws.

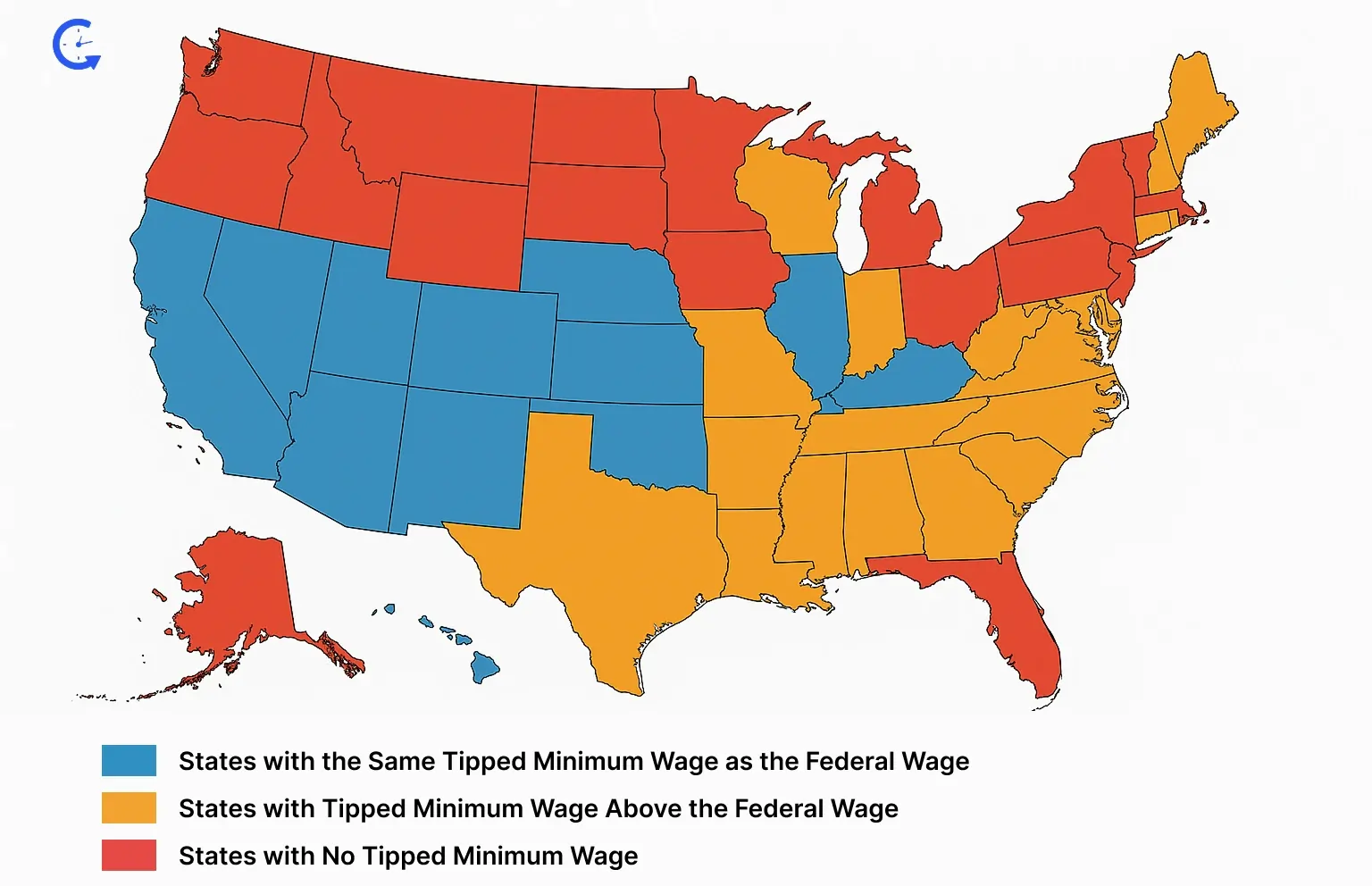

Tipped minimum wage laws in the U.S. vary widely from state to state—and in 2025, those differences matter more than ever. While the federal tipped wage sits at $2.13 per hour, many states have implemented their own, often higher standards. Some completely prohibit the use of tip credits, requiring employers to pay the full state minimum wage regardless of tips earned.

For employers, HR professionals, and payroll teams, staying compliant means knowing the specific rules in each state where tipped employees work. Below, we break down the current tipped minimum pay rates across all 50 states for 2025.

Here’s an US map showing tipped minimum pay by state:

While minimum wage laws vary widely across the U.S., some states follow the federal standard when it comes to tipped workers. These are typically jobs in restaurants, bars, salons, and other service-based industries where tips make up a significant portion of income. If you happen to be an HR professional, you must understand bi-weekly vs semi-monthly pay periods comparison, in order to align wage payments and compliance based on pay frequency.

Tipped minimum wage Georgia, tipped minimum wage Texas, tipped minimum wage Indiana, tipped minimum wage Missouri, and in some other US states mentioned in the table below, the tipped minimum pay is the same as the federal rate—$2.13 per hour. It’s important to note that employers are still required to ensure workers earn at least the regular minimum wage when tips are included.

Here’s a quick look at which states align with the federal tipped rate.

| State | Tipped Minimum Wage | Total Minimum Wage | Max Tip Credit |

| Alabama | $2.13 | $7.25 | $5.12 |

| Georgia | $2.13 | $7.25 | $5.12 |

| Indiana | $2.13 | $7.25 | $5.12 |

| Kansas | $2.13 | $7.25 | $5.12 |

| Kentucky | $2.13 | $7.25 | $5.12 |

| Louisiana | $2.13 | $7.25 | $5.12 |

| Mississippi | $2.13 | $7.25 | $5.12 |

| North Carolina | $2.13 | $7.25 | $5.12 |

| Oklahoma | $2.13 | $7.25 | $5.12 |

| South Carolina | $2.13 | $7.25 | $5.12 |

| Tennessee | $2.13 | $7.25 | $5.12 |

| Texas | $2.13 | $7.25 | $5.12 |

| Utah | $2.13 | $7.25 | $5.12 |

| Virginia | $2.13 | $12.00 | $9.87 |

| Wyoming | $2.13 | $7.25 | $5.12 |

Some states have taken steps to better support tipped workers by setting a minimum wage that’s higher than the federal tipped rate of $2.13 per hour. These states recognize that relying solely on tips isn’t always reliable or fair. To that end, they’ve boosted the base pay for workers in roles like servers, bartenders, and delivery drivers.

This means employers in these states must pay a higher hourly wage before tips are even factored in. Colorado tipped minimum wage, Florida tipped minimum wage, California tipped minimum wage, and some other US states follow this approach. Employees also have the option of working in swing shifts for a better work-life balance.

If you’re curious about rhode island minimum wage, idaho minimum wage and other states that offer more protection for tipped employees, the table below breaks it all down for you.

| State | Tipped Minimum Wage | Total Minimum Wage | Max Tip Credit | Notes |

| Alaska | $11.73 | $11.73 | N/A | Tip credit not allowed. Employers must pay full state minimum wage. |

| Arizona | $11.70 | $14.70 | $3.00 | Tip credit allowed up to $3.00. |

| Arkansas | $2.63 | $11.00 | $8.37 | Tip credit allowed up to $8.37. |

| California | $16.50 | $16.50 | N/A | Tip credit not allowed. Employers must pay full state minimum wage. |

| Colorado | $11.79 | $14.81 | $3.02 | Tip credit allowed up to $3.02. |

| Connecticut | $6.38 (servers) | $16.35 | $9.97 | Different rates for bartenders and servers. |

| Delaware | $2.23 | $15.00 | $12.77 | Tip credit allowed up to $12.77. |

| District of Columbia | $10.00 | $17.50 | $7.50 | Scheduled to increase to $12.00 on July 1, 2025. |

| Florida | $9.98 | $13.00 | $3.02 | Scheduled to increase to $10.98 on September 30, 2025. |

| Hawaii | $12.75 | $14.00 | $1.25 | Tip credit allowed up to $1.25. |

| Idaho | $3.35 | $7.25 | $3.90 | Tip credit allowed up to $3.90. |

| Illinois | $9.00 | $15.00 | $6.00 | Tip credit cannot exceed 40% of the applicable minimum wage. |

| Iowa | $4.35 | $7.25 | $2.90 | Tip credit cannot exceed 40% of the applicable minimum wage. |

| Maine | $7.33 | $14.65 | $7.32 | Tip credit allowed up to 50% of the applicable minimum wage. |

| Maryland | $3.63 | $15.00 | $11.37 | Tip credit allowed up to $11.37. |

| Massachusetts | $6.75 | $15.00 | $8.25 | Tip credit allowed up to $8.25. |

| Michigan | $5.99 | $12.48 | $6.49 | Tip credit allowed up to $6.49. |

| Minnesota | $11.13 | $11.13 | N/A | Tip credit not allowed. Employers must pay full state minimum wage. |

| Missouri | $6.88 | $13.75 | $6.87 | Tip credit allowed up to 50% of the applicable minimum wage. |

| Montana | $10.55 | $10.55 | N/A | Tip credit not allowed. Employers must pay full state minimum wage. |

| Nebraska | $2.13 | $13.50 | $11.37 | Tip credit allowed up to $11.37. |

| Nevada | $12.00 | $12.00 | N/A | Tip credit not allowed. Employers must pay full state minimum wage. |

| New Hampshire | $3.26 | $7.25 | $4.00 | Tip credit allowed up to 45% of the applicable minimum wage. |

| New Jersey | $5.26 | $15.13 | $9.87 | Tip credit allowed up to $9.87. |

| New Mexico | $3.00 | $12.00 | $9.00 | Tip credit allowed up to $9.00. |

| New York | Varies | Varies | Varies | Rates vary by region and occupation. |

| North Dakota | $4.86 | $7.25 | $2.39 | Tip credit allowed up to 67% of the applicable minimum wage. |

| Ohio | $5.25 | $10.45 | $5.20 | Tip credit allowed up to 50% of the applicable minimum wage. |

| Oregon | $14.70 | $14.70 | N/A | Tip credit not allowed. Employers must pay full state minimum wage. |

| Pennsylvania | $2.83 | $7.25 | $4.42 | Tip credit allowed up to $4.42. |

| Rhode Island | $3.89 | $15.00 | $11.11 | Tip credit allowed up to $11.11. |

| South Dakota | $5.75 | $11.50 | $5.75 | Tip credit allowed up to 50% of the applicable minimum wage. |

| Vermont | $7.01 | $14.01 | $7.00 | Tip credit allowed up to 50% of the applicable minimum wage. |

| Washington | $16.66 | $16.66 | N/A | Tip credit not allowed. Employers must pay full state minimum wage. |

| West Virginia | $2.62 | $8.75 | $6.13 | Tip credit allowed up to $6.13. |

| Wisconsin | $2.33 | $7.25 | $4.92 | Tip credit allowed up to $4.92. |

As of 2025, no US states have a tipped minimum pay below the federal rate of $2.13 per hour.

Yes, it’s true that some states like Wyoming and Georgia have set their own state minimum wages, which is below the federal minimum of $7.25 per hour. However, federal law makes it a must for employers to adhere to the higher federal standards. As a result, the enforceable tipped minimum pay in all states is at the minimum $2.13 per hour.

In some states, there’s no separate tipped minimum pay at all — tipped workers must receive the full state minimum wage, just like any other employee. That means employers can’t count tips toward meeting the minimum wage requirement.

This approach gives more financial stability to workers in industries where income can fluctuate from shift to shift. It’s a big step toward wage fairness, especially in roles like serving or bartending where tips aren’t always guaranteed. We would like to point out here that if you want to keep track of tipped workers’ attendance daily, weekly, monthly, or annually, employee attendance tracker Excel templates might just be the thing for you.

Below, you’ll find a list of the states that have eliminated the lower tipped minimum pay entirely. Tipped minimum wage Minnesota, dc tipped minimum wage, California tipped minimum wage are just to name a few.

| State | Tipped Minimum Wage | Tip Credit Allowed? | Notes |

| Alaska | $11.91 | ❌ No | Employers must pay the full state minimum wage; tips do not count towards it. |

| California | $16.00 | ❌ No | Full state minimum wage required; tips are separate from wages. |

| Minnesota | $11.13 | ❌ No | Employers must pay the full state minimum wage regardless of tips. |

| Montana | $10.55 | ❌ No | Tip credit is prohibited; full minimum wage must be paid. |

| Nevada | $12.00 | ❌ No | Employers must pay the full state minimum wage; tips are not considered. |

| Oregon | $14.70 | ❌ No | Tip credit is not allowed; full minimum wage applies. |

| Washington | $16.66 | ❌ No | Employers must pay the full state minimum wage without tip credit. |

Tipped minimum pay laws don’t just apply to the 50 states — U.S. territories have their own rules, too. From Puerto Rico to Guam, each territory sets its own policies when it comes to how tipped workers are paid.

Some follow federal guidelines, while others have adjusted rates to better fit their local economies. If you live or work in one of these areas (or you’re just curious), it’s helpful to know how the rules compare.

The table below outlines the minimum wage rates across U.S. territories, giving you a quick look at what workers earn in each location.

| Territory | Tipped Minimum Wage | Standard Minimum Wage | Tip Credit Allowed | Notes |

| American Samoa | $2.13 | $5.38–$6.79 | ✅ Yes | Minimum wage varies by industry; tipped employees must receive at least $2.13/hour in direct wages. |

| Guam | $8.25 | $8.25 | ❌ No | Tip credit not allowed; tipped employees must be paid the full minimum wage directly by employers. |

| Commonwealth of the Northern Mariana Islands (CNMI) | $2.13 | $7.25 | ✅ Yes | Tip credit allowed; employers must ensure that tipped employees’ combined wages and tips meet the standard minimum wage. |

| Puerto Rico | $2.13 | $10.50 | ✅ Yes | Employers covered by the Fair Labor Standards Act (FLSA) must pay at least $2.13/hour in direct wages to tipped employees. |

| U.S. Virgin Islands | $4.20 | $10.50 | ✅ Yes | Tipped employees must receive at least $4.20/hour in direct wages; combined with tips, total earnings must meet the standard minimum wage. |

Calculating the minimum wage for tipped employees requires a careful understanding of both federal and state laws. Since tipped employees earn part of their income through customer tips, employers must ensure that their total earnings meet or exceed the applicable minimum wage.

| Total Wage Calculation Base Wage + Tips = Total Hourly Wage |

If this total is less than the applicable minimum wage, the employer must cover the difference.

If a server in Florida (2025 minimum wage = $13.00) receives a $9.98 base wage and earns $3.50/hour in tips:

9.98+3.50 = 13.48

Since $13.48 > $12.00, the employer complies with wage laws.

Tip credit significantly affects how employers calculate wages for tipped employees, particularly in the hospitality and service industries. By factoring in the tips employees receive, businesses can reduce their direct wage expenses — while still ensuring employees earn at least the minimum wage.

The most immediate impact is the ability to pay a lower hourly base wage. For example, under federal law, employers can pay as little as $2.13 / hour, if tips make up the rest to meet the $7.25 / hour minimum wage. This reduces payroll costs while still meeting legal obligations.

Employers calculate tip credit by subtracting the cash wage they pay, from the applicable minimum wage.

| Formula: Minimum Wage – Cash Wage Paid = Tip Credit |

For instance, if the minimum wage is $7.25 and the employer pays $2.13/hour, the allowable tip credit is $5.12/hour. If an employee doesn’t earn enough tips to reach the full minimum wage, the employer must pay the difference.

Accurate documentation is critical. Employers must ensure that all tips are properly reported and recorded. Not just that, they should also ensure that employees’ total compensation (base wage + tips) meets or exceeds the legal minimum.

Opting for a definite payroll schedule and sticking to it is equally important. Failure to comply can lead to wage violations, fines, or lawsuits.

Using the tip credit can significantly lower labor costs. This becomes especially important in restaurants, hotels, and bars where tips are a substantial part of employee compensation. This model helps small businesses remain competitive while still providing employees the opportunity to earn more through tips.

Employers can also benefit from the FICA Tip Credit. This is a federal tax credit that offsets the employer’s share of Social Security and Medicare taxes paid on tip income. This credit can lead to significant annual tax savings for eligible businesses.

Tipped minimum pay allows employers to pay a lower hourly wage to employees who regularly earn tips, such as servers or bartenders, as long as their total earnings (wage + tips) meet or exceed the applicable minimum wage.

Under federal law in 2025, employers can pay as little as $2.13 per hour, if the employee earns enough in tips to reach the federal minimum wage of $7.25. If not, the employer must make up the difference.

Example:

If a server works 40 hours and earns $2.13/hour in wages and $300 in tips:

| ($2.13 × 40) + $300 = $385.20 total |

That’s $9.63/hour—well above the $7.25 requirement, so the employer complies.

State laws may vary, with some requiring higher base wages or prohibiting tip credits altogether. This, in turn, ensures tipped workers earn a fair and legal wage.

Tip credit allows employers to pay tipped employees less than the full minimum wage, using tips to cover the difference.

For example, under federal law, the minimum wage is $7.25/hour. If an employee earns $2.13/hour in base pay and receives $5.50/hour in tips, their total hourly wage becomes $7.63. The $5.12 difference between $7.25 and $2.13 is the tip credit.

Calculation:

$2.13 (base pay) + $5.50 (tips) = $7.63 (total wage) |

If the employee doesn’t earn enough in tips to reach $7.25/hour, the employer must make up the shortfall.

As of 2025, most U.S. states allow employers to use a tip credit. This means they can pay tipped employees a lower base wage as long as tips bring total earnings to the required minimum wage. States that allow tip credits include Florida, Texas, Ohio, Illinois, Pennsylvania, and Georgia, among others. However, the amount of the credit and the rules around it vary by state.

As of 2025, several U.S. states prohibit the use of tip credits, requiring employers to pay tipped employees the full state minimum wage, regardless of tips earned. These states include California, Oregon, Washington, Alaska, Minnesota, Montana, and Nevada.

In these states, tips are considered the employee’s property and are not used to offset wage obligations. This ensures a more stable income for workers in industries like restaurants, hospitality, and personal services.

Employers operating in these states must factor full hourly wages into their payroll budgets. They must also remain diligent in complying with local labor laws to avoid penalties or lawsuits.

Employers in the hospitality, restaurant, and service sectors must navigate complex wage laws to remain compliant when paying tipped employees. Here are key strategies to ensure you meet both federal and state requirements.

Under the Fair Labor Standards Act (FLSA), the federal minimum pay is $7.25/hour, and the tipped minimum pay is $2.13/hour.

Employers can use a tip credit of up to $5.12 to bridge the gap—provided that employees earn enough in tips to meet or exceed the minimum wage.

Many states enforce higher minimum wages or prohibit tip credits altogether. Some require employers to pay the full state minimum wage regardless of tips.

Always check your state and local wage laws, as noncompliance can result in significant penalties.

Employers must maintain accurate records of hours worked, base wages paid, and tips earned.

Employees must report all tips of $20 or more per month. Use point-of-sale systems and tip declaration forms to ensure accurate reporting. Employers should again report this tip to the Internal Revenue Service (IRS).

Tip pooling is legal but must follow FLSA and state guidelines. Only employees who regularly receive tips—such as servers and bartenders—may participate. Managers and supervisors are not eligible unless state law allows.

By staying informed and proactive, employers can ensure fair pay practices and avoid costly wage compliance mistakes. You must also consider tracking daily activities for better workplace productivity.

Accurate time tracking is essential when managing tipped employees—especially for calculating wages, verifying tip credits, and staying compliant with state and federal laws.

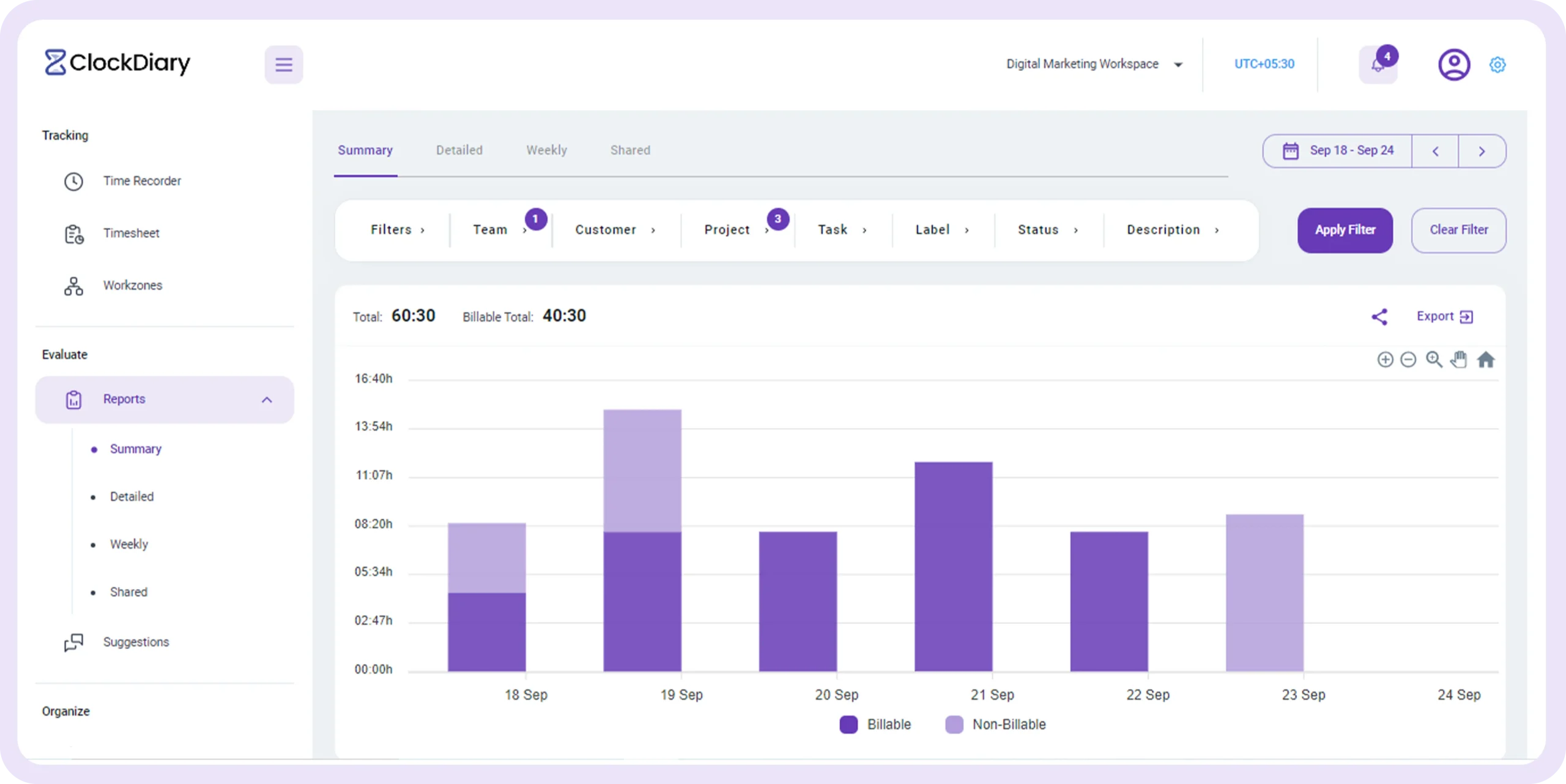

Clockdiary, an AI-powered free payroll time tracking software, helps employers in the hospitality and service industries monitor payroll hours with ease and precision. Here’s how Clockdiary supports better payroll management:

By using Clockdiary, employers can streamline their payroll process, eliminate guesswork, and ensure that tipped employees are paid fairly and on time—all while staying compliant with wage laws. Integrate this supremely engineered time tracking app into your workplace and you will be good to go.

Frequently Asked Questions:

Yes, tipped employees are legally required to make at least the applicable minimum wage when combining their base pay and tips. If their tips don’t bring their total earnings up to the minimum wage, the employer must pay the difference.

Tipped minimum wage is lower because the law assumes employees will earn enough in customer tips to meet or exceed the full minimum wage. This system allows employers to claim a “tip credit,” reducing their direct wage obligation as long as total earnings meet legal requirements.

In New York, the minimum wage for tipped employees depends on the industry and region. For example, restaurant servers in New York City must earn a base wage of $11.00 per hour, with tips expected to bring them up to the full minimum wage of $16.50 per hour.

In 2025, the tipped minimum wage Florida will be $10.98 per hour, effective from September 30, 2025. Employers can take a tip credit of up to $3.02, provided the employee’s total earnings meet the state minimum wage of $14.00 per hour.

In 2025, the tipped minimum wage in Illinois is $9 per hour. Employers can apply a tip credit of up to 40% of the state minimum wage. This, in turn, ensures the employee’s total earnings reach at least $15.00 per hour.

In 2025, the tipped minimum wage Michigan is $4.74 per hour. Employers can use a tip credit to ensure that an employee’s total earnings—including tips—meet the state’s full minimum wage of $12.48 per hour.

As of January 1, 2025, Ohio tipped minimum wage is $5.35 per hour, applicable to businesses with annual gross receipts exceeding $394,000. Employers must ensure that, when combined with tips, an employee’s total hourly earnings meet or exceed the state’s standard minimum wage of $10.70 per hour.