Ever wondered if your employees—or you—should be earning double time for those extra hours? In industries like healthcare, manufacturing, and retail, where extended shifts and holiday work are common, understanding double time pay is absolutely essential. .

While federal law mandates overtime at 1.5 times the regular rate, certain states, such as California, require double time wages under specific conditions, like working over 12 hours in a day or on the seventh consecutive workday. With compensation costs for private industry workers averaging $44.67 per hour in December 2024, misclassifying pay can lead to significant financial implications.

| Quick Summary: Understand everything about double time pay — what it is, when it’s required, and how to calculate it accurately. This comprehensive guide covers eligibility criteria, including non-exempt employees, salaried workers, and union members, along with state-specific regulations. Learn the step-by-step method to calculate double time pay, the difference between overtime and double time, and how to set up a compliant double time pay policy for your business. Plus, discover how Clockdiary can help you stay compliant by efficiently tracking employee hours and overtime. |

For small to mid-sized business owners, HR professionals, and employees in shift-based industries, grasping the intricacies of double-time pay is crucial. Misunderstandings can lead to compliance issues or missed earnings. In this guide, we’ll demystify, double time meaning, double time pay meaning, when it applies, and how to calculate it accurately. Let’s delve in and ensure you’re well-informed on this critical aspect of compensation.

Double time refers to a premium pay rate that compensates employees at twice their regular hourly wage for specific hours worked—typically beyond standard overtime thresholds. While the Fair Labor Standards Act (FLSA) sets federal guidelines for overtime (1.5x pay), it doesn’t mandate double time; instead, it’s governed by state laws, union contracts, or employer policies.

For example, if you are wondering when does double time start in California, we would like to point out that California law requires double time after 12 hours in a workday. Double time is often applied on holidays, weekends, or excessive hours, serving as an incentive and legal safeguard for fair compensation in demanding or extended work scenarios.

Now, that we are done with define double time, let’s take a look at what is actually meant by double time pay in the next section.

Double time pay is a wage rate that compensates eligible employees at twice their standard hourly rate for qualifying hours worked. It’s designed to reward labor performed under strenuous or extended conditions—like working over 12 hours in a day, seven consecutive days, or on certain holidays, depending on company policy or state law.

For instance, if an employee earns $20/hour, double time pay would be $40/hour. While not federally required under the FLSA, double time wages is enforced in states like California and commonly outlined in union agreements or employer-specific rules to ensure fair labor practices. Employees should also have a fair understanding of net vs gross pay for effective payroll tracking.

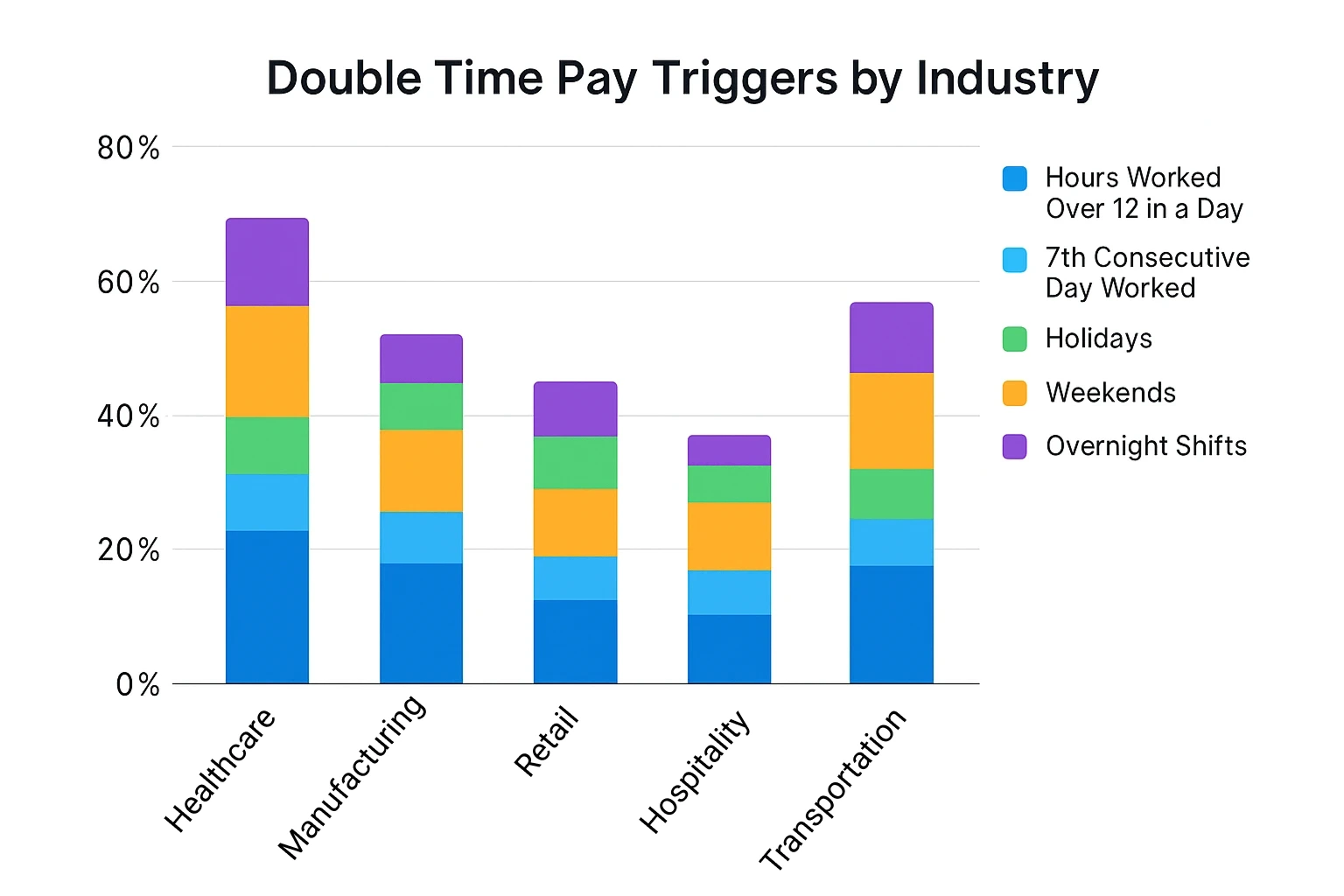

Double time pay isn’t universally required by federal law, but in certain states and industries, it kicks in under specific conditions. Understanding when double time applies is key to staying compliant and avoiding costly payroll errors. Here are the most common scenarios where double overtime pay may be required:

While standard overtime (1.5x pay) begins after 40 hours in a week under the Fair Labor Standards Act (FLSA), some states—like California—require double time pay when employees work more than 12 hours in a single day. This means if an employee works 13 hours in a day, the 13th hour is compensated at twice the regular rate. Accurately calculating hours worked is extremely important. This provision is especially important in shift-based industries where long days are common.

The goal is to fairly compensate employees for extended work periods that go beyond normal expectations.

You might be wondering, is holiday pay double time? We would like to point out here that federal law doesn’t require extra pay for working on holidays. However, many employers offer double holiday pay as a benefit. In the private sector, 75% of employees receive paid holidays, with an average of 7.6 paid holidays per year. Some states have specific laws:

In California, employees working seven consecutive days in a workweek must receive:

Kentucky also mandates time and a half for employees working seven consecutive days in a workweek. We would like to point out here that there might be instances where employees work in the second shift followed by the third shift as well. In that case, working in multiple shifts can be considered as consecutive work days if work hours exceed the stipulated time period.

Some states have unique thresholds triggering double time pay:

Employers must be aware of these state-specific regulations along with the number of pay periods in a year to ensure compliance and fair compensation for employees.Ensuring accurate application of double time wages is essential to avoid legal complications and maintain employee trust. Regularly reviewing state laws and company policies can help businesses stay compliant and encourage a fair workplace environment.

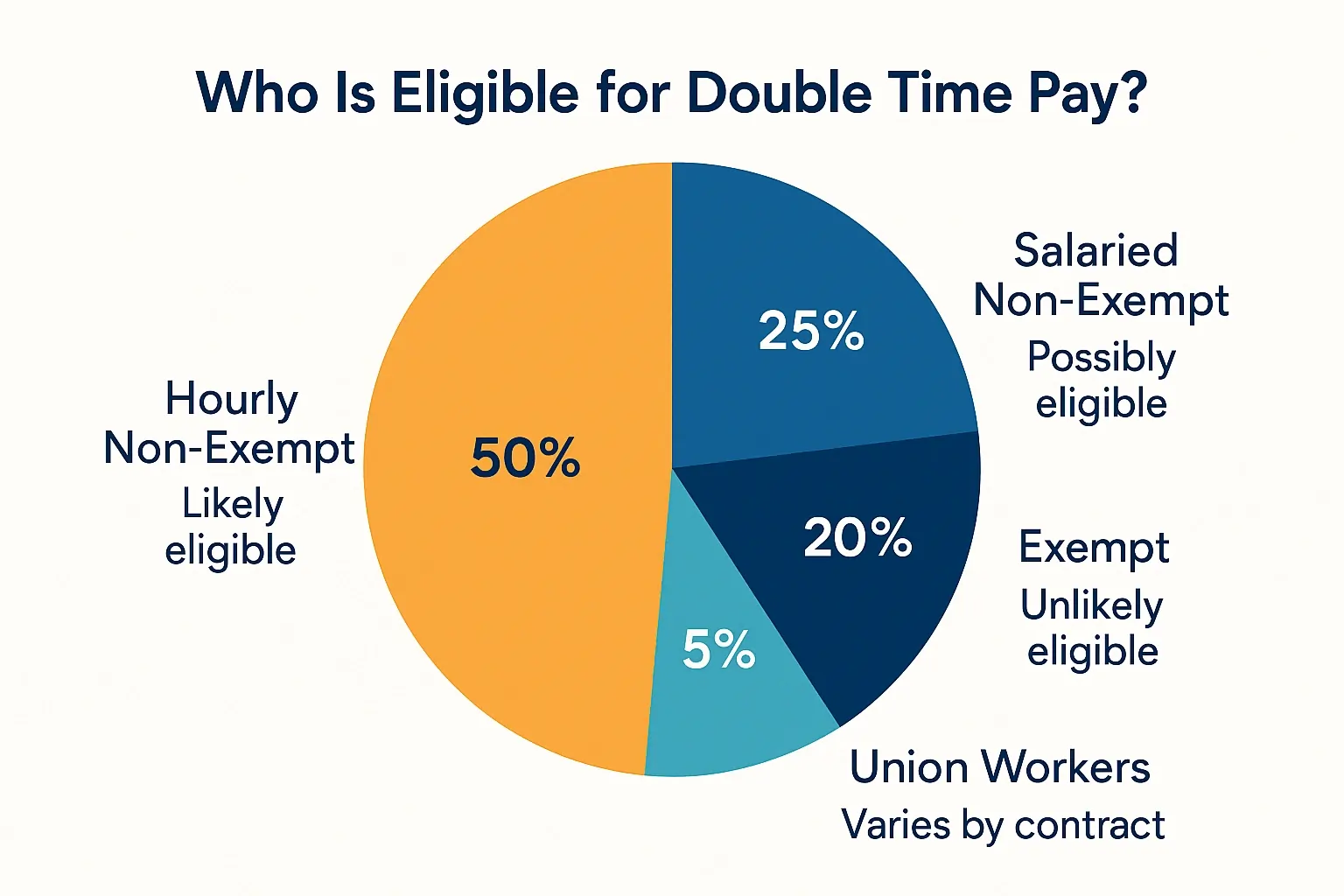

Double time pay eligibility largely depends on employment classification, state laws, industry standards, and company policies. While federal law does not mandate double time, certain employees are entitled to it based on where they work and their job type.

In most cases, only non-exempt employees—those eligible for overtime under the Fair Labor Standards Act (FLSA)—qualify for double pay. These are typically hourly workers in industries like healthcare, manufacturing, construction, and retail, where long or irregular shifts are common.

Exempt employees, such as salaried professionals, managers, and administrative roles who meet certain criteria, are not entitled to double time. A clear idea of the minimum wage in Washington state and other US states is also a must.

Recent updates to the FLSA have increased the salary thresholds for overtime eligibility. Effective July 1, 2024, salaried employees earning less than $43,888 annually are eligible for overtime pay, with the threshold rising to $58,656 on January 1, 2025. Employees below these thresholds may qualify for double overtime pay if stipulated by state laws or employer policies.

Collective bargaining agreements often include provisions for double time pay. Unionized employees in industries like manufacturing, transportation, and healthcare may be eligible for double time under specific circumstances outlined in their contracts.

Many employers voluntarily offer double overtime pay to attract and retain talent, especially in industries prone to long shifts or critical operations. Internal policies may grant double pay on holiday work, weekends, or last-minute scheduling.

States like California have explicit laws requiring double overtime pay under certain conditions. Employers must familiarize themselves with state-specific labor laws and tipped minimum wage laws to ensure compliance.

Employers should regularly review federal and state labor laws, as well as any applicable union contracts, to determine double time pay eligibility and ensure accurate compensation practices.

Calculating double time pay is a breeze if you follow a clear step-by-step approach. Here’s how to do it accurately:

Start with the employee’s regular hourly wage. This is the base rate they earn for each hour of standard work, excluding bonuses or shift differentials.

Formula:

| Regular Hourly Rate = Weekly Salary / Total Weekly Hours Worked |

Example: If an employee earns $800 per week and works 40 hours, the hourly rate is $800 ÷ 40 = $20/hour.

Next, calculate the double time rate by multiplying the regular rate by two.

Formula:

| Double Time Rate = Regular Hourly Rate X 2 |

Continuing the example: $20 × 2 = $40/hour.

Double time is typically applied to hours worked:

Assume the employee worked 14 hours in one day in California. Hours 1–8 are regular, 9–12 are overtime (1.5×), and hours 13–14 are double time. Setting up a clock-in and clock-out system in the workplace is always a good idea to track the number of hours employees work.

Multiply the number of double timing hours by the double time rate.

Formula:

| Double Time Pay = Double Time Hours X Double Time Rate |

If an employee worked 2 double time hours, the calculation is:

2 × $40 = $80 in double time pay.

Finally, add the double time earnings to the employee’s total regular and overtime pay for that period to determine gross wages.

Example Breakdown:

Total Pay = $160 + $120 + $80 = $360

Accurate calculation not only ensures legal compliance — it also helps maintain employee trust and avoid costly payroll disputes.

While salaried employees are typically exempt from overtime and double time pay under the Fair Labor Standards Act (FLSA), exceptions do exist. If a salaried worker is classified as non-exempt, they may still be eligible for pay double time depending on state laws, union agreements, or specific job duties.

To calculate double time for a salaried employee, first determine their regular hourly rate based on their weekly salary.

Formula:

| Regular Hourly Rate = Weekly Salary / Total Weekly Hours (usually 40) |

Then, calculate the double time rate:

| Double Time Rate = Regular Hourly Rate X 2 |

Finally, multiply the double time rate by the number of double time hours worked:

| Double Time Pay = Double Time Rate x Double Time Hours |

Let’s say a nonexempt salaried employee earns $1,000 per week and works 14 hours in one day in California. California law requires double time pay for hours worked beyond 12 in a day.

Step 1: Find the Regular Hourly Rate

$1000 / 40 = $25 / hour

Step 2: Calculate The Double Time Rate

$25 X 2 = $50 / hour

Step 3: Determine Double Time Hours

If the employee worked 14 hours, the final 2 hours (beyond 12) qualify for double time.

Step 4: Calculate Double Time Pay

2 X $50 = $100

This $100 in double overtime pay would be added to the employee’s total compensation for the week, in addition to regular and any overtime wages. You can also take help of a double time pay calculator for the same.

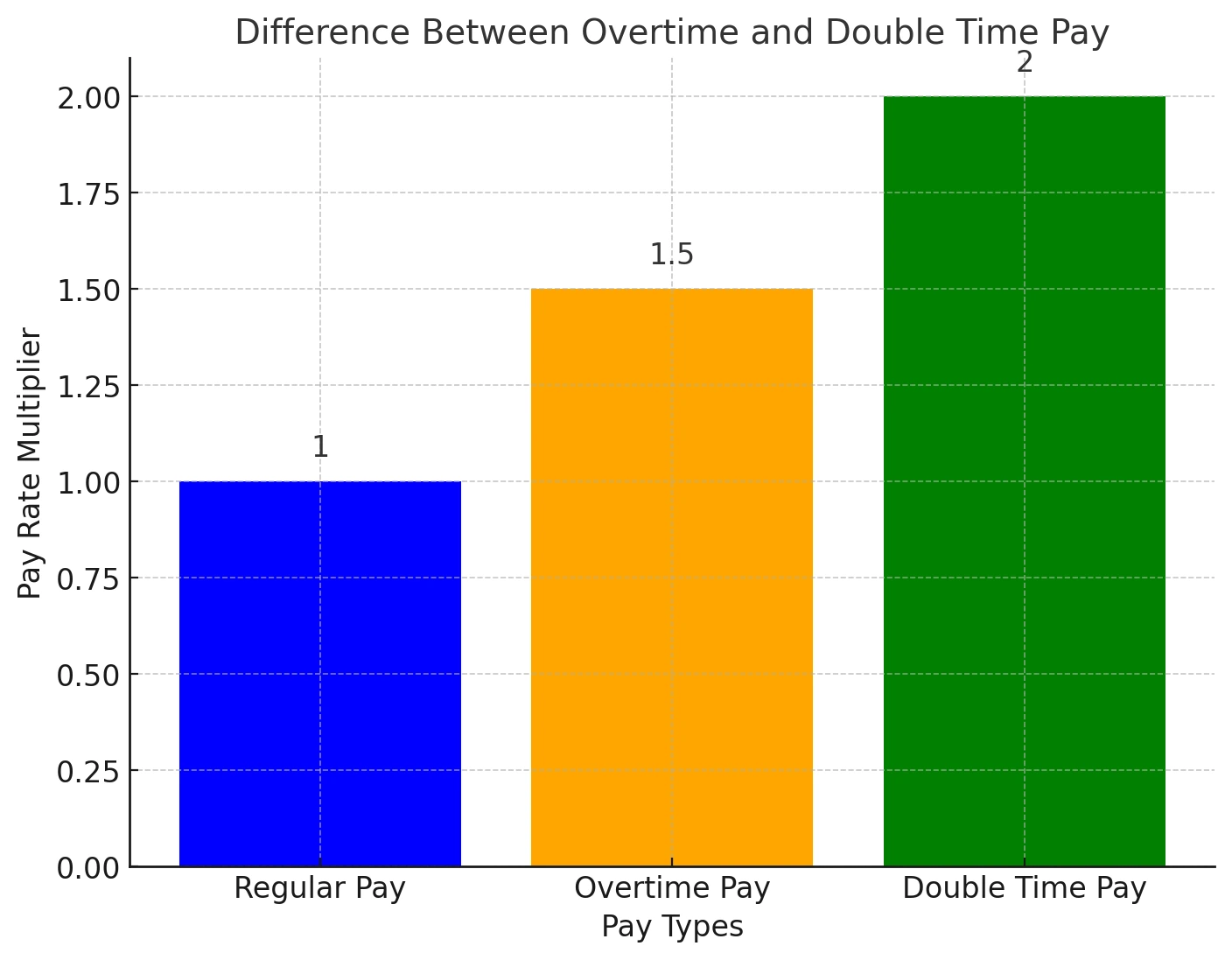

Understanding double time vs overtime comparison is essential for accurate payroll processing and legal compliance. While both offer premium compensation for extra work, they apply under different conditions and at different rates. The table below breaks down the key differences:

| Aspect | Overtime Pay | Double Time Pay |

| Definition | Extra pay at 1.5x the regular hourly rate for hours worked beyond 40 in a week (federally) or 8 hours per day (in some states) | Extra pay at 2x the regular hourly rate for hours worked beyond specific thresholds (e.g., 12 hours / day or 7th consecutive day). |

| Pay Rate | 1.5 times the employee’s regular hourly wage | 2 times the employee’s regular hourly wage |

| Frequency | More common; applies frequently in weekly payrolls where employees exceed standard hours. | Less common; only applies under specific conditions like extended daily shifts or holiday work. |

| Legality | Required by federal law (FLSA) and most state laws. | Not required by federal law; mandated in some states (e.g., California) or by union contracts / employer policy. |

| Examples | An employee works 45 hours in a week: 5 hours are paid at 1.5x rate. | An employee works 13 hours in a day in California: the 13th hour is paid at 2x rate. |

Quick Reference:

Employers should note that failing to understand overtime vs double time comparison correctly can result in payroll violations, employee dissatisfaction, and costly penalties. Ensure that your time-tracking systems like Clockdiary and payroll processes reflect these rules—especially if you’re operating in states like California, where both are strictly regulated. Mention not, as an employer or HR professional, you should also have a clear understanding of semi-monthly vs bi-weekly pay periods for effective payroll processing.

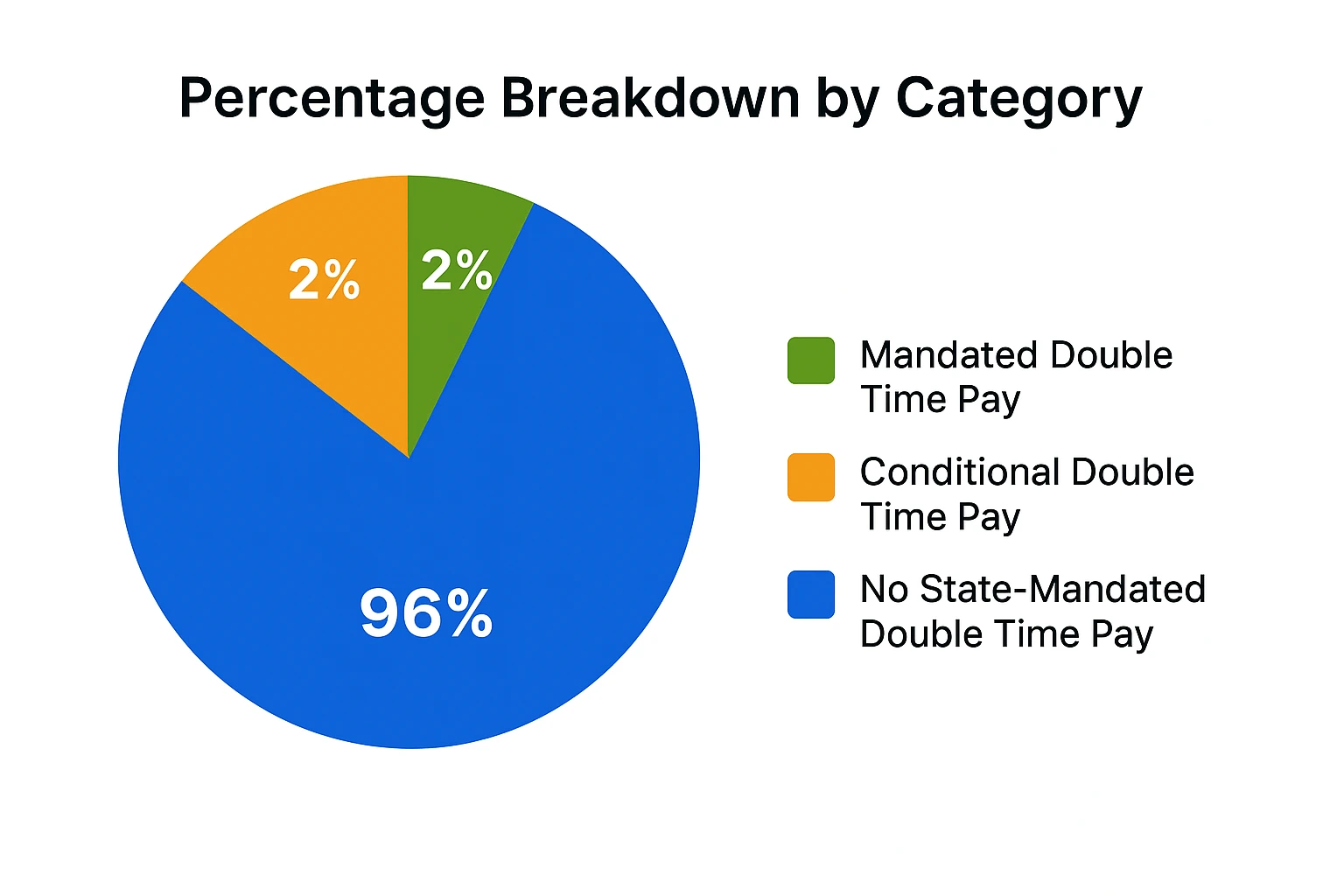

It goes without saying that understanding double time pay is critical for employers and HR professionals to not just ensure fair compensation but compliance as well. While federal law doesn’t mandate double time wages, certain states have specific regulations. Here’s an overview:

California stands out as the only state with explicit double time pay laws. Under California Labor Code Section 510, non-exempt employees are entitled to double their regular rate of pay in the following situations:

California double time pay provisions are designed to protect workers from excessive work hours and ensure they are fairly compensated for extended labor.

Most other states do not require double time pay by law. Instead, they follow the federal FLSA standard, which only requires overtime at 1.5x the regular rate after 40 hours in a workweek. However, some employers in states like Nevada, Washington, and New York may offer double time voluntarily—especially for holidays or emergency shifts—as part of company policy or union agreements.

It’s important to note that while these states have specific overtime rules, they do not mandate double time pay as California does. Employers should consult state labor laws to ensure compliance with local regulations. Also, there are employees who may work on a per diem basis. You must make sure that they are fairly compensated for their efforts, and that too, on a daily basis.

Employers operating in multiple states should stay informed about varying labor laws to maintain compliance and uphold fair labor practices.

Creating a clear and legally compliant double time pay policy helps businesses manage payroll accurately, avoid disputes, and ensure fair employee compensation. Here’s how to build an effective policy step-by-step:

Start by clearly outlining when double time will be paid. This typically includes:

Establish how double time was calculated:

By systematically defining, calculating, documenting, implementing, and reviewing your double time pay policy, and by tracking employee hours without breaching privacy, you can promote a transparent and compliant work environment that recognizes and rewards employee efforts during critical periods.

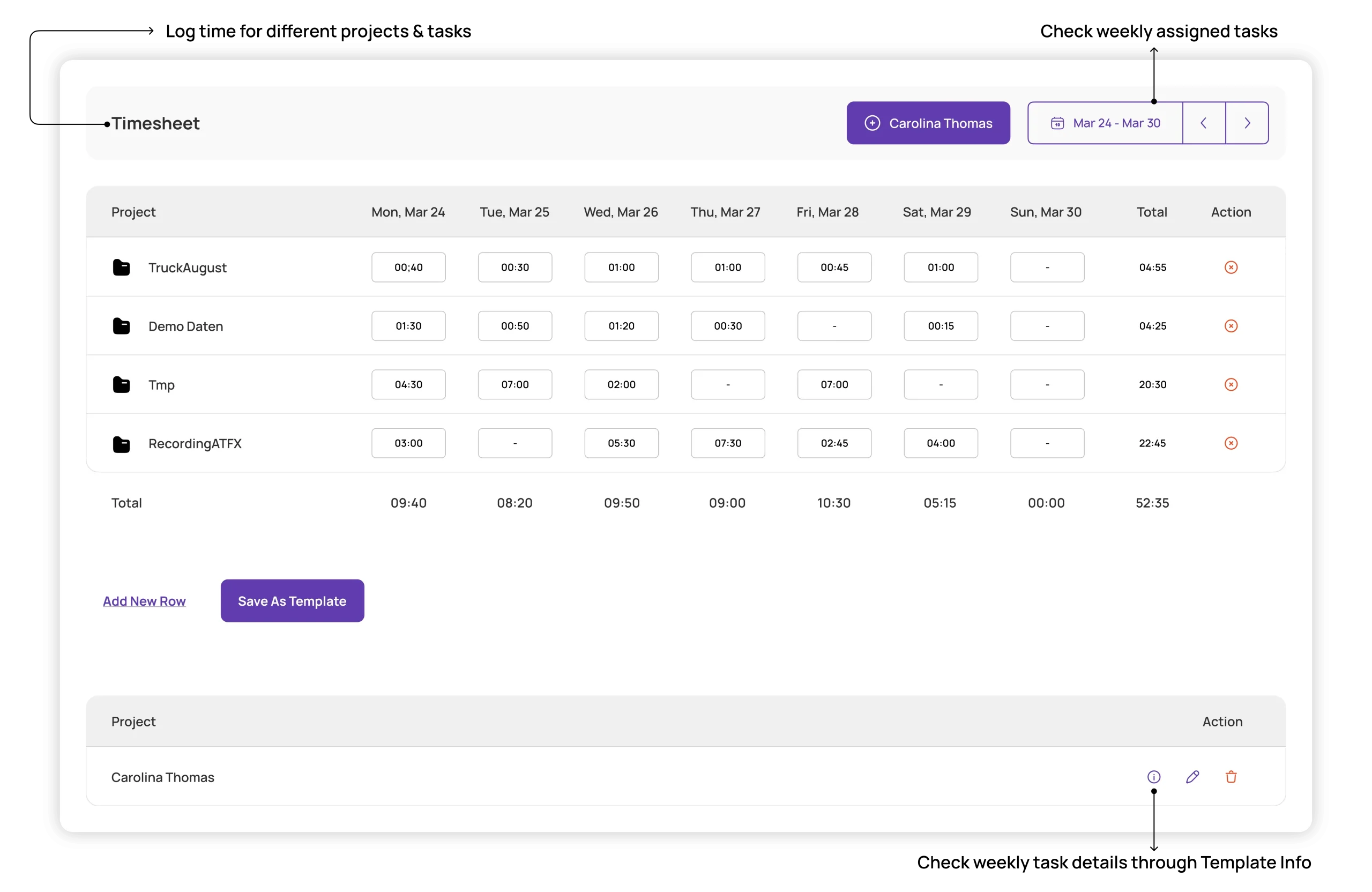

Managing double time pay accurately starts with reliable time tracking—and that’s exactly where Clockdiary shines. Whether you’re a small business owner, HR professional, or payroll administrator, Clockdiary makes it easier to comply with federal and state labor laws, including double time regulations.

Here’s how Clockdiary supports compliance and accurate payroll:

Using Clockdiary helps small and mid-sized businesses simplify compliance, reduce payroll errors, and build a transparent pay system employees can trust. So what are you waiting for? Get in touch with us to integrate this supremely engineered time tracking app into your workflow and you will be good to go.

FAQs About Double Time Pay:

Double overtime, also known as double time, is a premium pay rate of twice an employee’s regular hourly wage for certain extended work hours. It usually applies when employees work more than 12 hours in a day or over 8 hours on the seventh consecutive day, depending on state laws like in California.

Double time typically kicks in when a non-exempt employee works more than 12 hours in a single day or over 8 hours on the seventh consecutive day of a workweek, depending on state laws like those in California. It may also apply during holidays or emergency shifts if outlined in an employer’s policy or a union agreement.

Double time pay rate is calculated by multiplying an employee’s regular hourly wage by two. For example, if someone earns $20 per hour, their double time rate would be $40 per hour.

Double time pay for someone earning $21 an hour means they receive $42 per hour during double time-eligible hours. This rate is calculated by multiplying the regular hourly wage by two: $21 × 2 = $42.

Sunday is not automatically considered double time pay under federal or most state laws unless it qualifies as overtime or is specified in an employer’s policy or union agreement. However, some companies voluntarily offer double time for Sunday shifts as part of their weekend or holiday pay policies.

California is currently the only U.S. state with clearly defined double time pay laws, requiring it after 12 hours in a workday or on the seventh consecutive workday. Other states, like Alaska, Nevada, and Colorado, have unique overtime rules, but they do not mandate double time pay.

No, Texas does not have laws mandating double time pay. Employees in Texas are entitled to overtime pay at 1.5 times their regular rate for hours worked over 40 in a workweek, as per federal law, but double pay is not required unless specified by an employer’s policy or contract.