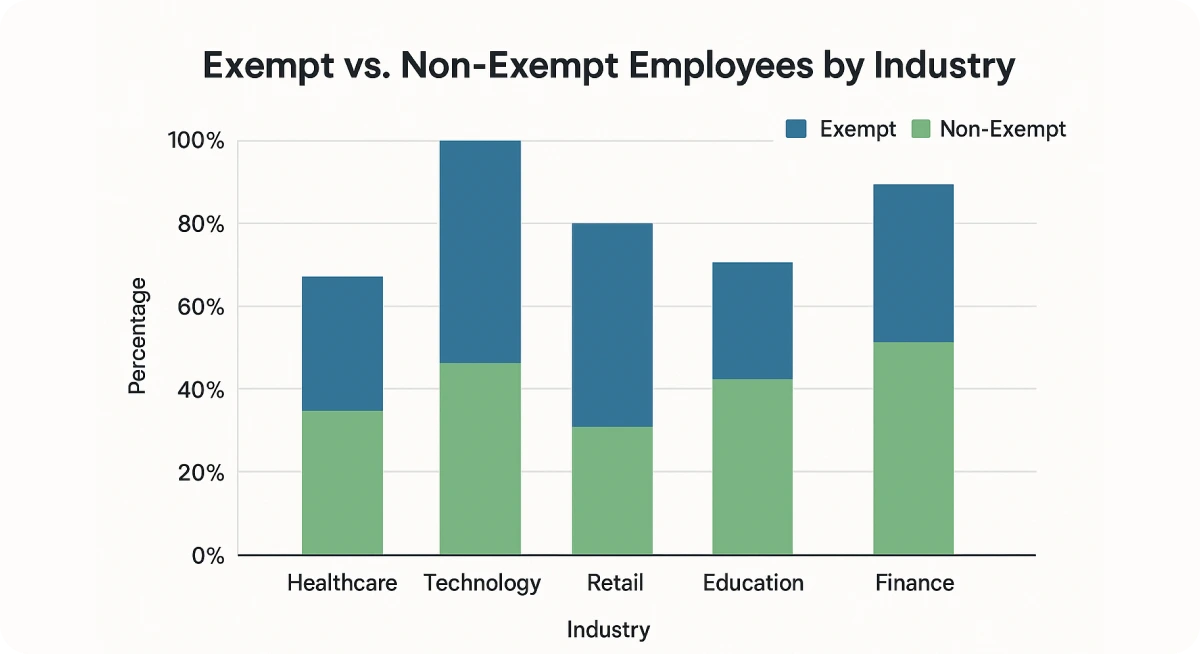

Are your employees classified correctly as exempt or non-exempt? If you are an employer, HR, or a business owner, this question matters more than you might think. According to the U.S. Department of Labor, employers pay millions of dollars each year due to employee misclassification.

Misunderstanding between exempt vs non exempt employees can affect payroll accuracy and lead to costly lawsuits and penalties. Properly classifying an employee as exempt or non-exempt impacts compensation, making it essential for both parties to understand.

In this blog, we’ll break down the comparison between exempt vs non exempt employees, explore wage and hour laws and outline the risks of misclassification.

What is an Exempt Employee?

Before diving into exempt vs non exempt employees, it’s important to understand what “exempt” really means in the workplace. Employment law in the United States draws a clear line between exempt and non exempt employees.

What does Exempt Mean?

In employment law, exempt describes a legal status where certain workers or job categories are released from specific wage and hour protections under the Fair Labor Standards Act (FLSA). Being “exempt” means the position itself is not covered by rules such as overtime pay or federal minimum wage, provided it meets the required salary and duties tests.

Exempt Employee Definition

An exempt employee is a worker who is not covered by federal overtime pay and minimum wage requirements under the Fair Labor Standards Act (FLSA). These employees are usually paid a fixed salary rather than an hourly wage and are commonly found in executive, administrative, or professional positions.

Exempt Employee Examples

In order to know the difference between exempt vs nonexempt employees, employers must first be clear of their distinct roles. Here are common roles that often qualify when their primary duties and pay structure meet the tests:

- Executive: Store managers who run a location, schedule staff, direct at least two full-time team members, and significantly influence hiring decisions.

- Administrative: HR managers or operations analysts whose day-to-day work involves policies, budgeting, compliance, or vendor strategy and who regularly use independent judgment.

- Learned/Creative Professional: Engineers, CPAs, architects, and RNs (learned professional); or art directors, writers, and designers whose work requires originality and talent (creative professional). Teachers, lawyers, and doctors are exempt regardless of the salary threshold.

- Computer Employee: Software developers, systems analysts, or DevOps engineers whose primary duty is systems analysis, programming, or software design; they may be salaried or hourly.

- Outside Sales: Field sales representatives who spend most of their time meeting clients off-site to make sales or obtain contracts; minimum salary does not apply.

What is a Non-exempt Employee?

When it comes to employee classification, “non-exempt” is the most common category under U.S. labor law. These workers make up a large portion of the American workforce and are directly protected by wage and hour laws.

Understanding what non-exempt status means is important for both employers, who must follow strict pay and recordkeeping rules, and employees, who deserve fair compensation for every hour worked.

What does Non-exempt Mean?

“Non-exempt” refers to being subject to federal wage and hour laws, particularly those outlined in the Fair Labor Standards Act (FLSA). It means the person or role is not exempt from protections like minimum wage and overtime requirements. In other words, “non-exempt” indicates inclusion under these labor laws, ensuring extra pay for overtime and compliance with time-tracking rules.

Definition of Non-exempt Employee

A non-exempt employee is a worker who is entitled to federal minimum wage and overtime pay protections under the Fair Labor Standards Act (FLSA). This means they must receive at least one and one-half times their regular rate of pay for all hours worked beyond 40 in a workweek.

Employees who are non-exempt may be paid hourly or on a salary basis, but unlike exempt employees, who are typically paid a fixed salary and not eligible for overtime, they remain covered by overtime pay requirements.

Non-exempt Employee Examples

Roles of non-exempt employees are typically those whose duties are more task-oriented, directly supervised, or measured in hours worked rather than by the exercise of independent judgment or advanced professional training. Common examples include:

- Retail associates: Retail associates and cashiers often work regular hourly schedules, handling customer transactions, stocking shelves, and providing service on the sales floor.

- Customer service: Representatives are usually scheduled for shifts or evaluated based on the number of calls they handle. Their work hours are carefully recorded, making them eligible for overtime compensation when they exceed standard limits.

- Administration: Administrative assistants and clerical staff perform routine office tasks such as scheduling, data entry, or filing. Unless their responsibilities rise to a level that meets an exemption test, these employees are typically considered non-exempt.

- Hospitality: Hospitality and food service workers, such as servers, cooks, bartenders, and hotel staff, usually work on hourly schedules. Many of these roles involve tip-related pay structures, which fall under special minimum wage and tip-credit rules, but they remain non-exempt and overtime eligible.

- Manufacturing: Warehouse workers handle production, packaging, shipping, and inventory tasks. Their work is closely tied to hours on the job, and employers must track those hours to calculate overtime pay accurately.

- Healthcare: Support staff, including nursing assistants, home health aides, and medical technicians, typically provide hands-on care under the direction of licensed professionals. Unless their role meets a specific exemption, they are classified as non-exempt and entitled to overtime protection.

Key Differences Between Exempt and Non-Exempt Employees

Understanding the distinction between exempt vs non exempt employees goes beyond job titles. It directly affects how workers are paid, their eligibility for overtime, and the protections they receive under wage and hour laws.

Knowing these key differences helps employers stay compliant and ensures employees understand their rights at work.

Compensation: Salary vs. Hourly

One of the easiest ways people spot the difference between exempt vs non exempt employees is how they’re paid.

- Exempt employees are usually paid a fixed salary, meaning they earn the same base pay each pay period regardless of how many hours they work.

- Non-exempt employees are generally paid on an hourly basis, and their pay directly reflects the number of hours worked.

- However, salary alone doesn’t make someone exempt. Employers can also classify workers as salaried non-exempt, in which case they are still entitled to overtime pay.

|

Factor |

Exempt Employees |

Non-exempt Employees |

|---|---|---|

|

Pay structure |

Fixed salary |

Hourly (or sometimes salaried but overtime-eligible) |

|

Pay fluctuations |

Same each period |

Varies with hours worked |

|

Overtime eligibility |

Not entitled (if truly exempt) |

Always entitled |

|

Example |

Marketing Manager, Software Engineer |

Retail Associate, Customer Service Rep |

Overtime Eligibility

Overtime eligibility is one of the most significant differences between exempt vs non exempt employees, and it directly affects how workers are compensated for time worked beyond standard hours. Understanding how overtime pay rules work is essential for compliance with labor laws, particularly under the Fair Labor Standards Act (FLSA), as well as state-specific regulations.

Exempt Employees

- Exempt employees are not entitled to overtime pay if they meet the FLSA’s salary basis, salary level, and duties tests.

- These workers are typically paid a fixed salary regardless of hours worked, meaning whether they put in 35 hours or 55 hours in a week, their paycheck remains the same.

- Their roles usually involve higher-level responsibilities such as management, supervision, or the application of specialized professional knowledge, which justifies their exemption status.

Non-exempt Employees

- Non-exempt employees are always covered by overtime protections.

- They must receive at least 1.5 times their regular rate of pay (“time and a half”) for all hours worked over 40 in a standard workweek.

- Unlike exempt employees, whose compensation is directly tied to hours worked, which means additional hours worked translate into higher pay.

Regular Rate of Pay Explained

- The regular rate used to calculate overtime is more complex than just the hourly wage:

- It includes hourly pay, but also certain bonuses, commissions, and incentive payments.

- Non-discretionary bonuses (e.g., productivity bonuses) must be factored into the overtime rate.

- Discretionary bonuses (e.g., holiday gifts) do not count toward the regular rate.

- Employers must ensure correct calculation; errors can lead to costly back pay claims and penalties.

Federal vs. State Overtime Rules

While the FLSA sets the federal standard (time-and-a-half for hours over 40 in a week), some states have stricter rules:

- California: Requires overtime pay for hours worked over 8 in a single day and double time for hours worked over 12 in a day.

- Alaska, Colorado wage, and Nevada wage: These cities also have daily overtime thresholds.

- In states with stronger protections, employers must comply with whichever rule is more favorable to the employee (federal or state).

Example overtime calculation

Suppose a non-exempt employee earns $20.00/hour and works 50 hours in a week:

Regular hours = 40 × $20.00 = $800.00

Overtime hours = 10 × (1.5 × $20.00) = 10 × $30.00 = $300.00

Total weekly pay = $800.00 + $300.00 = $1,100.00

Job Duties

When determining the difference between exempt vs non exempt, it’s not the job title that matters; it’s the actual duties performed.

The U.S. Department of Labor (DOL) and the Fair Labor Standards Act (FLSA) emphasize that classification of non-exempt vs exempt must be based on the substance of the role, not the label given by the employer.

This distinction prevents organizations from simply assigning “manager” or “specialist” titles to avoid overtime obligations.

Exempt Job Duties

Exempt positions are typically tied to executive, administrative, professional, computer-related, or outside sales roles. What sets them apart is the level of responsibility, decision-making, and specialized expertise required.

Key Characteristics of Exempt Duties

- Supervision and management: Overseeing teams, scheduling, hiring, and disciplining employees.

- Independent judgment: Making decisions on matters of significance without constant supervision.

- Specialized knowledge: Applying advanced education or professional expertise (e.g., doctors, lawyers, engineers).

- Strategic contribution: Involvement in planning, directing operations, or shaping company policies.

Non-Exempt Job Duties

Non-exempt positions are defined by task-oriented work that is closely supervised and often repetitive. These jobs focus on execution rather than strategy, and employees’ pay is directly tied to hours worked.

Key Characteristics of Non-exempt Duties

- Routine tasks: Performing set activities with limited variation (e.g., data entry, customer checkout).

- Direct supervision: Following detailed instructions from a manager or supervisor.

- No independent authority: Minimal or no discretion in making significant business decisions.

- Time-based measurement: Work tracked in shifts or hours rather than outcomes.

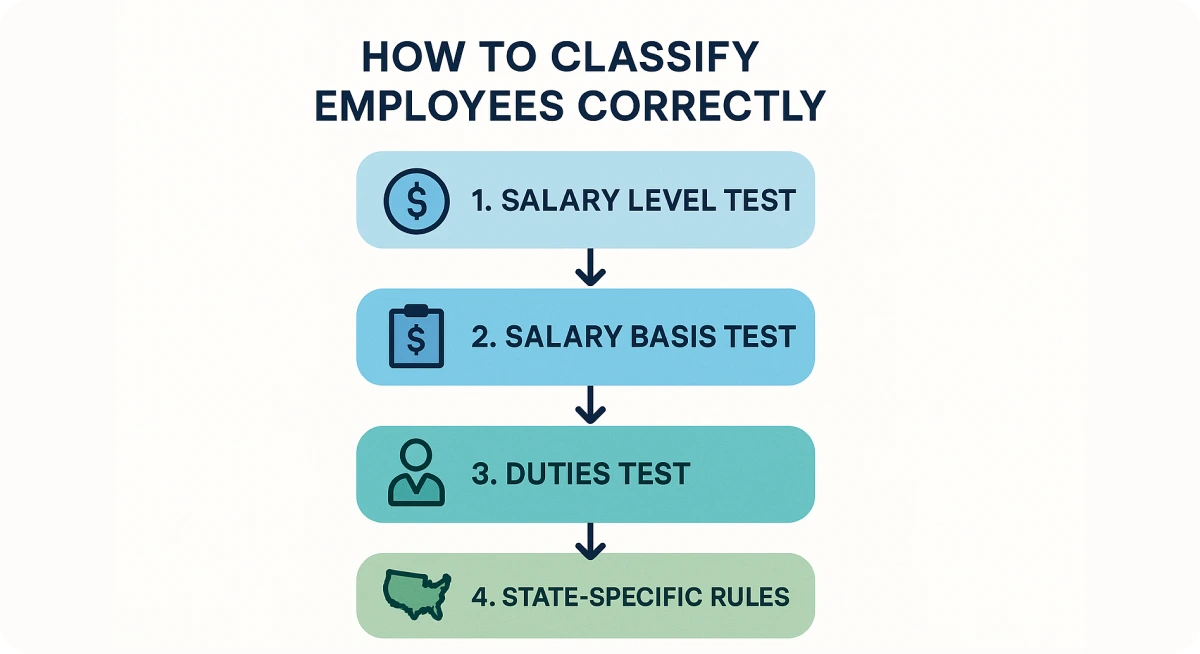

The “Duties Test”

The Department of Labor applies a duties test to determine exempt vs non exempt employees. For example:

- Executive exemption: Must regularly supervise at least two full-time employees and have input on hiring/firing decisions.

- Administrative exemption: Must perform office or non-manual work directly related to management or general business operations, using discretion and judgment.

- Professional exemption: Must require advanced knowledge in a field of science or learning, typically acquired through specialized education.

- Computer exemption: Applies to certain IT roles like systems analysts or software engineers (but not routine tech support).

- Outside sales exemption: Requires making sales away from the employer’s place of business.

Benefits & Flexibility

Here is a comprehensive table comparing the benefits and flexibility of exempt vs non exempt employees:

|

Aspect |

Exempt Employees |

Non-Exempt Employees |

|---|---|---|

|

Compensation Structure |

Paid a fixed salary, regardless of hours worked. |

Paid hourly (or salaried but overtime-eligible), directly tied to hours worked. |

|

Overtime Pay |

Not eligible for overtime; extra hours do not increase pay. |

Entitled to overtime pay (1.5x regular rate) for hours over 40 in a week (or daily thresholds in some states). |

|

Work Schedule |

Greater flexibility in start/end times; often outcome-based rather than time-based. |

More structured, with clearly defined shifts and break schedules. |

|

Autonomy & Flexibility |

Higher autonomy in managing tasks, projects, and sometimes location (e.g., remote or hybrid work). |

Limited control over schedules; expected to follow set hours and supervisor direction. |

|

Workload Expectations |

May be expected to work long or unpredictable hours without additional pay. |

Workload usually capped at scheduled hours; additional work is compensated through overtime. |

|

Benefits & Perks |

Often eligible for enhanced benefits such as performance bonuses, stock options, professional development, and extra paid leave. |

Generally receive standard benefits (healthcare, retirement, PTO), but fewer high-level perks compared to exempt employees. |

|

Job Security & Stability |

Salaried stability provides consistent income, regardless of weekly hour fluctuations. |

Income may fluctuate based on hours worked, but overtime provides earning potential. |

Pros and Cons of Exempt vs. Non-exempt Employees

Choosing between exempt vs non exempt status has implications not only for payroll but also for work-life balance, career growth, and compliance. Each classification carries unique advantages and drawbacks for both employees and employers.

Exempt roles often offer stability and higher-level perks but may come with long hours and high expectations. Non-exempt positions, on the other hand, provide overtime protection and clearer work boundaries, but they may limit flexibility and advancement opportunities.

Understanding these trade-offs is essential for creating fair workplace policies and helping employees make informed career choices. Here is a table comparing exempt vs nonexempt pros and cons:

| Category | Pros | Cons |

| Exempt Employees | Stable, predictable salaries regardless of hours worked. Often eligible for enhanced benefits such as bonuses, stock options, and paid leave. More autonomy in how and when work is performed. Stronger career advancement opportunities, especially into leadership roles. | No overtime pay, even if working 50-60 hours a week. Workloads can be heavy and unpredictable. May face pressure to always be available (emails, calls after hours). Income doesn’t increase with additional hours worked. |

| Non-Exempt Employees | Guaranteed overtime pay (time-and-a-half or higher) for extra hours. Clearly defined schedules with better work-life boundaries. Pay directly tied to hours worked, increasing earning potential with overtime. Protection under federal and state wage-and-hour laws. | Less flexibility in choosing schedules; must adhere to shifts. Often receive fewer perks compared to exempt employees. Earnings can fluctuate if hours are reduced. Limited autonomy and fewer opportunities for advancement unless transitioning to exempt roles. |

Tax Implications: Exempt vs. Non-exempt

From a tax standpoint, both exempt and nonexempt employee are treated similarly in that they are subject to federal income tax, state and local income tax (where applicable), and FICA contributions (Social Security and Medicare).

Employers withhold these taxes from paychecks and report wages on Form W-2 at year-end. However, the way employees are classified, exempt or non exempt, can indirectly affect taxation due to differences in pay structure, consistency, and reporting requirements.

Exempt Employees

- Fixed salary structure: Exempt employees generally receive the same gross pay each pay period, regardless of hours worked. This makes tax withholdings more predictable and consistent.

- No overtime income: Since exempt employees are not entitled to overtime, their taxable wages typically remain steady, unless they receive performance bonuses or other incentive pay.

- Predictable tax liability: Because earnings are stable, exempt employees are less likely to see major fluctuations in withholding or quarterly tax estimates.

- Benefits-related taxation: Exempt employees often receive additional perks (e.g., stock options, bonuses, tuition reimbursement), which may have separate tax implications such as capital gains or additional withholding.

Non-Exempt Employees

- Variable income: Paychecks can fluctuate each pay period depending on hours worked, overtime, and shift differentials.

- Overtime taxation: Overtime increases taxable wages, which can cause employees to temporarily fall into a higher withholding bracket, though annual tax liability is based on total income.

- Bonuses and incentive pay: Like exempt workers, non-exempt employees may also receive bonuses or commissions. These must be added to the regular rate for overtime calculations, complicating payroll taxes.

- Unpredictable take-home pay: Employees may see varying net pay, making it harder to plan for personal budgeting or tax withholding accuracy.

Employer Considerations

For employers, tax compliance is not just about withholding, it’s about correctly calculating wages for exempt or non exempt employees so that tax reporting aligns with labor law requirements.

- Payroll accuracy: Employers must carefully calculate overtime for non-exempt staff, including adjustments for bonuses and commissions. Any miscalculation can lead to underpayment, back pay obligations, IRS penalties, and Department of Labor investigations.

- W-2 Reporting: Both exempt and non-exempt employee salary, along with withheld taxes, are reported on Form W-2. However, the fluctuating nature of non-exempt pay makes payroll processing more complex.

- State-specific rules: Some states require additional wage statement disclosures, such as daily hours worked or overtime details, which can add complexity for non-exempt payroll reporting.

- Benefits taxation: Employer-provided benefits (e.g., health insurance, retirement contributions, fringe benefits) may have tax implications that affect both groups equally. However, since exempt employees often receive more non-cash benefits, payroll teams must carefully account for taxable fringe items.

What are the Wage and Hour Laws for Exempt and Non-exempt Employees?

This section breaks down the practical law you need to know about classifying and paying employees, the federal baseline rules, pay cycles like hourly, bi-weekly, or semi-monthly, and the recordkeeping and break rules employers must follow.

Federal Salary Threshold

The current baseline of the U.S. Department of Labor (Wage & Hour Division) enforced is: $684 per week (equivalent to $35,568/year) as the minimum salary for most executive, administrative, and professional (EAP) exemptions.

If an employee’s pay is below the applicable federal salary threshold, they generally cannot be exempt under the EAP tests, even if their duties look managerial.

Several states and cities set higher thresholds (or different tests). If a state rule is more protective than the federal rule, employers must follow the state rule for workers in that state.

Meal and Rest Break Laws

No federal law requires employers to provide lunch or coffee breaks. However, short rest breaks (typically 5-20 minutes) are counted as hours worked and must be paid. Bona fide meal periods (generally 30 minutes or longer where the employee is relieved of all duties) are not counted as hours worked.

State Requirements

In states like California, the law is much more protective:

- Meal periods: Employees who work more than 5 hours are generally entitled to a 30-minute unpaid, duty-free meal period (a second meal if they work more than 10 hours).

- Rest breaks: A 10-minute paid rest break is required for every 4 hours or major fraction thereof.

If an employer fails to provide required breaks, the employee can be entitled to premium pay (paid as an hour at the regular rate) for each missed break. Always confirm the exact state rule and exceptions.

Recordkeeping Requirements

The FLSA requires employers to keep accurate payroll and hours records. Key points (DOL guidance):

Minimum records employers should keep for each covered, non-exempt worker:

- Employee’s full name and Social Security number.

- Address, birth date (if under 19).

- Gender and occupation.

- Time and day of week workweek begins.

- Hours worked each day and total hours worked each workweek.

- Basis on which wages are paid (hourly, salary, etc.), regular hourly rate, overtime rate.

- Total daily or weekly straight-time earnings, total additions/deductions, total wages paid each pay period, and date of payment.

Retention periods:

- Payroll records, collective bargaining agreements, sales/purchase records: retain for at least 3 years.

- Records used to compute wages (timecards, work schedules, wage rate tables): retain for at least 2 years.

How State Laws Affect Exempt and Non-exempt Employees?

State-specific labor laws shape how the federal FLSA baseline applies in real workplaces, and they can change classification outcomes overnight. Some states raise the salary floors for exemptions, add daily overtime or stricter duties tests, or create carve-outs for particular occupations.

The practical result: employers must follow the most protective law that applies to the worker (federal vs. state/local), and that often means running a state-level check in addition to the federal tests.

Salaried Non-exempt Employees

A common point of confusion is that “salaried” does not automatically mean “exempt.” Employers may lawfully pay a worker a fixed salary and still treat them as non-exempt, provided the worker is paid minimum wage for all hours worked and receives overtime when due.

Employers sometimes assume salaried staff don’t need time-tracking; that’s risky. Payroll needs accurate hour records for salaried non-exempt staff so overtime is computed correctly, and state laws may impose additional recordkeeping or pay-frequency rules.

Best practice is to document how much the salary is intended to cover, keep contemporaneous time records, and make overtime calculations transparent to the employee.

Hourly Exempt Employees

Although most exempt roles are salaried, there are exceptions where an employee can be paid hourly and still qualify as exempt under federal rules. The clearest example is certain computer-related occupations.

For these kinds of jobs, the DOL’s regulations allow a computer professional to be exempt if paid on a salary or fee basis at least $684/week or on an hourly basis at a sufficient hourly rate.

In addition, outside sales employees are exempt from the EAP salary test because their primary duty, making sales away from the employer’s place of business, triggers a distinct exemption with no minimum salary requirement.

To accurately calculate employee hours worked, organizations can use time tracking apps that is compliant with privacy laws and regulations.

Other Unique State Variations

While the Fair Labor Standards Act (FLSA) sets the national baseline for minimum wage, overtime, and exemption rules, states can and often do provide stronger protections.

Employers must properly know the comparison of exempt vs non exempt employees and follow whichever law is more favorable to each type. This means that if state law is stricter than federal law, the state rule applies.

Here are the most important areas where state laws differ between nonexempt vs exempt and why they matter:

1. Minimum Wage Laws

- Federal minimum wage: $7.25/hour (unchanged since 2009).

- State variations: Many states (and cities) have significantly higher minimum wages.

- California (2025): $16.00/hour statewide, with some cities like San Francisco and Los Angeles above $18/hour.

- Washington minimum wage: $16.28/hour (highest statewide minimum in the U.S. as of 2025).

- Texas & Georgia: Still follow the federal $7.25/hour.

Impact on classification of exempt vs non exempt employees:

Since the salary threshold for exempt employees is often tied to state minimum wage, higher state minimums = higher exempt salary thresholds.

For example, in California, exempt employees must earn 2x the state minimum wage for full-time work, which equals $66,560/year in 2025. This is nearly double the federal minimum for exemption.

2. Tipped Wage Rules

The federal tipped minimum wage is $2.13/hour (if tips bring the worker to at least $7.25/hour).

State differences:

- California, Oregon, Washington: Do not allow tip credits. Tipped employees must earn the full state minimum wage before tips.

- New York: Allows a tip credit but requires a higher base wage than federal (e.g., $10/hour for food service workers plus tips).

- Texas & most Southern states: Follow federal rules, meaning tipped employees may receive just $2.13/hour from the employer.

Employers must carefully track tips to ensure total compensation meets state or federal minimums. Missteps in tipped wage compliance often lead to lawsuits.