What would a single compliance lapse cost your organization today? Recent reports show the average financial impact of a non-compliance incident is around $4 million. At the same time, the compliance management software market is expected to grow to nearly $60.02 billion, highlighting how businesses worldwide are using structured compliance frameworks to avoid costly mistakes.

Management system compliance goes beyond ticking boxes or fulfilling audit requirements. It ensures that policies, processes, and procedures align with industry regulations, internal standards, and international best practices. Done right, it becomes a powerful shield, reducing operational risks, preventing financial penalties, and protecting brand reputation in a competitive marketplace.

In this blog, we’ll explore why management system compliance is so critical, what its essential elements are, and how to build an effective framework that actually supports growth.

What is a Management System Compliance?

Management system compliance refers to an organization’s ability to align its internal processes, policies, business metrics, and operations with established standards, regulations, and best practices. It can also be known as a compliance management system (CMS).

In simple terms, it’s about making sure the way a business is managed follows the rules, whether those rules come from government regulations, international standards (like ISO), industry guidelines, or the company’s own policies.

Management system compliance can be considered as the bridge between organizational processes and accountability. It ensures companies operate responsibly, ethically, and in line with the law, while also improving credibility, minimizing risks, and building trust with customers, stakeholders, and regulators.

For example, businesses handling sensitive data must comply with GDPR, HIPAA, or ISO standards to ensure data protection and security. Organizations can ensure their compliance through compliance management tools.

What are the Elements of a Management System Compliance?

A strong management system compliance is a set of practical elements that work together to reduce legal, financial, and reputational risk while helping the business operate more predictably. Below are some of the core elements of management system compliance.

1. Leadership and Governance Oversight

Compliance systems start with senior leaders and the board deciding how much attention and budget the program gets, and create accountability through roles like a Chief Compliance Officer or a compliance committee.

Standards like ISO 37301 and regulatory guidance (for example, from the U.S. Department of Justice) explicitly call out leadership commitment and governance as foundational to an effective compliance management system.

In practice, make compliance a standing board agenda item, assign clear owners for major risks, and require periodic leadership sign-off on key policies.

2. Clear Policies, Standards, and Procedures

Management system compliance should say, plainly, what is allowed, what isn’t, and who makes the decisions. Advanced compliance management solutions include checklists, workflows, and role-based instructions, unlimited PTO, and other organizational policies that make compliance repeatable.

It also includes well-written policies that are short, linked to the specific regulation or risk they address, and paired with targeted training so people know both the “how” and the “why.” Version control, easy accessibility, and a policy-to-control mapping are practical must-haves of management system compliance.

3. Risk Assessment and Internal Controls

A management system compliance aids with risk management and compliance as well. It starts with a systematic risk assessment: identify what can go wrong, who it affects, how likely it is, and how bad the impact would be.

Organizations can update their management system compliance when processes or laws change. Once risks are prioritized, they can design internal controls, including preventive and detective, to reduce exposure to acceptable levels.

Well-known frameworks such as NIST (a U.S. standard for cybersecurity and risk) and COSO (a global model for internal controls) provide organizations with structured methods to identify risks, assess their impact, and set up controls to manage them consistently.

4. Compliance Monitoring and Auditing

Management system compliance includes monitoring (automated alerts, dashboards, sampling) and independent auditing (internal and external) to check whether policies are being followed and controls are working.

Monitoring lets you spot trends early; audits validate both design and operating effectiveness. A modern approach to management system compliance blends automated continuous monitoring where possible, with periodic in-depth audits that include root-cause analysis and clear, time-bound corrective actions.

Businesses and organizations use KPIs like percentage of controls tested, time-to-close audit findings, and trend lines for repeat issues to watch program health.

5. Reporting and Incident Management Mechanisms

When something goes wrong, the speed and quality of your response matter more than the mistake itself. Through management system compliance, organizations can ensure reporting channels are well-publicized and trusted.

Incident management procedures define how to triage, investigate, notify regulators or affected parties if needed, contain harm, and remediate root causes. Management system compliance should also include playbooks for common incident types (data breach, fraud, safety event) and run tabletop exercises so response teams know their roles.

After every incident, do a lessons-learned review and update policies and controls accordingly. NIST’s incident response guidance and industry best practices emphasize preparation, detection, containment, and post-incident learning.

6. Documentation and Record-Keeping

Documentation, including policies, risk registers, training logs, audit reports, incident records, and corrective action plans, is part of the policy management tool.

Good record-keeping follows clear rules for naming, versioning, retention, access control, and secure storage. Accurate, retrievable records in your management system compliance make audits easier and let leadership and regulators see that you acted deliberately and consistently.

Many standards require documented evidence of “what you did and why,” so build documentation into processes (automated logs, sign-offs, and time-stamped records) rather than treating it as an afterthought.

Practical systems range from lightweight document management plus spreadsheets to full governance, risk, and compliance (GRC) platforms, depending on your size and complexity.

Why is Management System Compliance Important?

Management system compliance is the foundation that keeps a business honest, dependable, and ready for growth. At its core, compliance means the way an organization runs its processes matches the rules, standards, and promises it has to customers, regulators, and itself.

That alignment brings practical benefits for everyone involved: the organization as a whole, the business owner, every employee, and the people who invest in or depend on the company. Let’s see them below:

For Organizations

For the organization, compliance control creates stability and predictability. When processes are defined and followed, the company delivers consistent results, whether that’s product quality, service response times, or data security.

That consistency reduces waste, errors, and rework. It also lowers legal and regulatory risk: following applicable laws and recognized standards means fewer surprises like fines, shutdowns, or costly legal disputes.

Beyond risk reduction, compliance helps with decision-making and continuous improvement. If risk registers, audits, and metrics are in place, leaders can see what’s working and what isn’t, and make targeted changes.

Compliance also strengthens relationships across the supply chain: customers, partners, and regulators prefer working with organizations that can demonstrate reliable controls and documented processes. In short, a compliant organization is more resilient, more efficient, and easier to scale.

For Business Owners

For owners and senior leaders, the practical upside is financial and strategic. A legal compliance management system prevents expensive mistakes, regulatory fines, lost contracts, or reputational damage that can cost far more than the cost of running the program. It improves predictability in operations and cash flow, which makes planning and investment easier.

Compliance also opens doors. Many customers, especially larger enterprises and public-sector buyers, require proof of certain standards or controls before they’ll sign a contract. Being compliant raises your chances of winning bids and entering new markets.

From a valuation perspective, buyers and investors often pay more for companies with clean audit trails, documented processes, and a history of meeting regulatory obligations. Finally, compliance can lower insurance premiums and reduce the likelihood of surprises during due diligence.

For Employees

Employees benefit when compliance program management is included in everyday work. Clear policies and procedures mean people know what’s expected of them and how to do their jobs safely and correctly.

That clarity provided by management system compliance reduces stress and confusion, improves productivity, and lowers the chance of mistakes that could harm customers or coworkers.

Health, safety, and data-protection rules directly protect workers with fewer accidents, better mental well-being, and less chance of being personally exposed in risky situations. Training and documented career pathways tied to compliance standards also help employees grow professionally.

Finally, trusted reporting channels and visible leadership support create a culture where staff feel safe to raise concerns without fear of retaliation, and that often uncovers issues early before they become crises.

For Investors and Stakeholders

Investors, lenders, and other stakeholders look for signals that a company is well governed and that its risks are under control. Through a strong management system compliance program, you will be able to provide transparent reporting, consistent processes, effective controls, and documented responses to incidents.

From an investor’s point of view, compliance reduces the odds of sudden losses from regulatory action, scandal, or operational failure. It supports reliable financial forecasting and often leads to a lower cost of capital because the business appears less risky.

For stakeholders such as customers, regulators, and partners, compliance management demonstrates accountability and long-term thinking, which improves confidence, customer loyalty, and the company’s license to operate.

How to Build an Effective Management System Compliance?

Building an effective management system compliance is a practical program where you design, run, and improve. Here is a clear, step-by-step approach that anyone in a small team or a large organisation can follow to build an effective compliance management system:

1. Identify Regulatory and Industry Requirements

Start by mapping what actually applies to your organisation. That means listing laws, regulations, and standards that affect your business (for example, GDPR, HIPAA, sector-specific licensing rules, or ISO standards such as ISO 37301 for compliance management).

Don’t forget to include industry guidance, contractual obligations (customer or supplier clauses), and voluntary standards that your customers expect.

- Create an “applicability matrix”, a table that links each law/standard to the business areas it affects (HR, IT, finance, operations).

- Include owners for each requirement and a short note on status (compliant/partial/gap).

- Review this matrix at least annually and whenever you launch a new product or enter a new market.

2. Assess Compliance Risks and Gaps

Once you know the rules, run a risk-focused gap assessment in your management system compliance. Treat compliance activities as risk assessments. Identify where the organisation could fail to meet a requirement, how likely that is, and what the impact would be (legal, financial, reputational). Use a living risk register that ranks issues so you can prioritise effort.

- Use a simple risk heat-map (likelihood × impact) to prioritise issues.

- For high-risk areas, do a deeper root-cause gap analysis: processes, people, systems, third-party exposures.

- Don’t forget third-party/vendor risk, as many compliance failures start with suppliers. Use questionnaires or attestations to capture their controls.

- Templates and guidance from recognised frameworks (for example, NIST’s risk assessment guidance) can speed this work and make it repeatable.

3. Define Policies, Procedures, and Controls

When defining management system compliance, translate obligations and risks into clear, usable policies and operating procedures. Policies state principles and high-level rules; procedures and checklists show the exact steps people must take. Every policy should map to specific compliance and control, like the actions, tools, or checks that make the policy real.

- Keep policies short and readable. Add a one-page “what it means for you” for each audience (HR, sales, developers).

- In order to maintain compliance, create a policy-to-control matrix so every policy has at least one measurable control.

- Version-control documents, store them centrally, and make sure staff know where to find the latest version. Use automated approvals for updates if possible.

4. Assign Roles and Responsibilities

Management system compliance shows clarity on who does what and prevents tasks from falling through the cracks. Management system compliance frameworks ensure a named owner for each requirement, policy, and risk. Beyond a compliance officer, use a cross-functional model: legal, IT, HR, operations, and product should each have accountable leads.

- Define a RACI (Responsible, Accountable, Consulted, Informed) for major processes (incident response, vendor onboarding, audits).

- Appoint a senior sponsor (often a C-level or board member) who will back the program politically and financially.

- Create a compliance committee that meets regularly to review risk, incidents, and audit results. Service roles and clear role-based responsibilities are commonly adopted in practical guides.

5. Implement the Right Compliance Tools and Technology

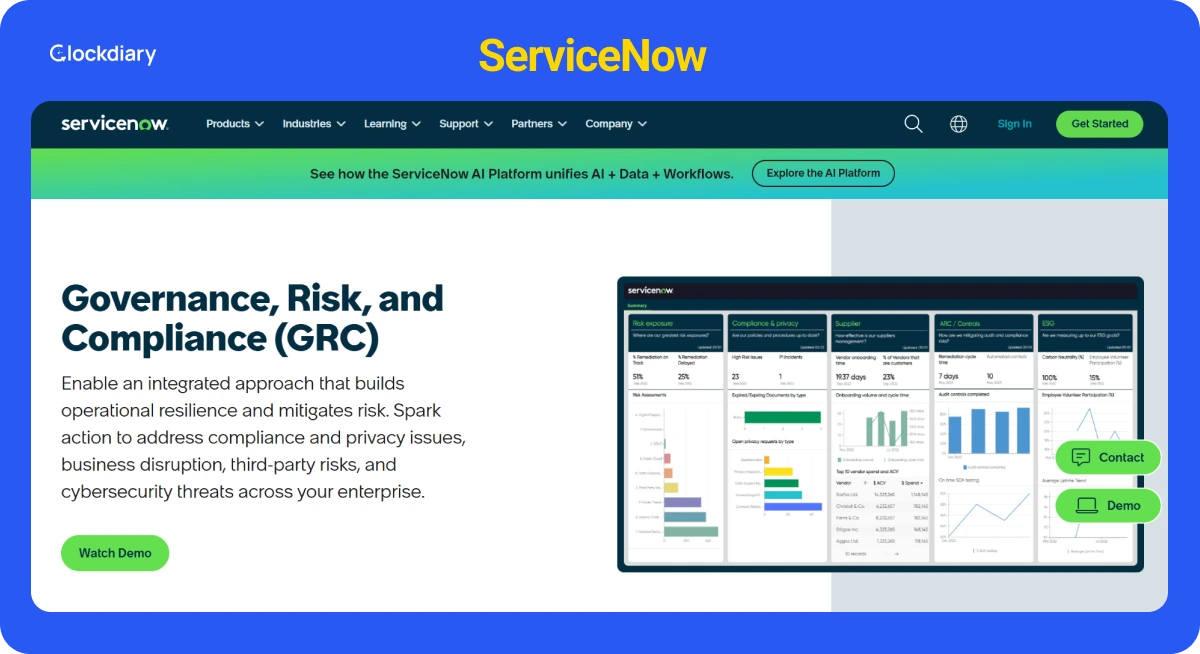

Technology makes a small team scale. Governance, Risk, and Compliance (GRC) platforms, policy libraries, vendor-risk tools, and continuous monitoring systems help automate repetitive tasks, centralise records, keep away from compliance issues, and produce dashboards for leadership.

- Start with the problems: choose tools that solve your top priorities (vendor risk? audit management? policy versioning?).

- Evaluate GRC tools for workflow flexibility, integrations (HR systems, ticketing, identity), and reporting, not just feature lists.

- Consider continuous monitoring for high-risk areas (security configs, access controls) and automation for evidence collection, but be cautious about emerging tech (e.g., AI) and validate outputs.

6. Train and Educate Employees Regularly

Organizations that implement IT compliance management should provide proper training to their employees. Training should be practical, role-based, and ongoing, not a one-off checkbox, and should provide enough information on policies related to them, on tipped wages, double time pay, etc. Focus on behaviours and decision-making rather than only legalese.

- Use short, scenario-based modules (microlearning) tied to real situations people face on the job.

- Require onboarding training and annual refreshers; add immediate training when policies or systems change. Measure completion and comprehension (quizzes, simulations).

- Make training relatable: use examples from your own organisation, run tabletop exercises for incident response, and gather feedback to improve content.

7. Monitor, Audit, and Continuously Improve

To manage compliance properly, you need to blend ongoing compliance monitoring with periodic audits (internal and external) in your management system compliance. Treat findings as a learning loop where you investigate the root cause, implement corrective actions, and measure closure.

- Define KPIs such as percent of controls tested, time-to-close corrective actions, number of incidents by severity, and vendor-risk scores.

- Use continuous compliance monitoring for tech-heavy controls (configuration drift, access anomalies) and periodic sampling for process controls (invoicing, approvals).

- Run regular audits and tabletop exercises; ensure audit findings have owners, timelines, and verification.

- Publish an executive dashboard for leadership to make informed decisions.

- Continuous improvement is the goal. Use each incident and audit as a source of program upgrades.

Critical business processes such as invoicing and approvals should receive special attention, since errors here can directly affect financial integrity and regulatory standing.